AI and Crypto Trades Cool as Market Sentiment Shifts

The stock market didn’t crash this week, but signs of weakness are starting to show in high-risk areas. After months of wild speculation by retail investors and huge bets on artificial intelligence, some of the flashiest parts of the market are beginning to cool off.

Big-name tech stocks took a hit, marking their worst performance since April. Companies like Palantir and Oracle dropped sharply, dragging down leveraged ETFs and popular meme-stock trades. These losses hint that the recent hype around AI might be wearing thin.

One of the clearest warning signs is coming from the crypto world. Bitcoin, which had surged earlier this year, is now sliding. It’s been dropping toward $100,000 again and again, as fewer buyers are stepping in. Many investors who used leverage have already been wiped out, and confidence in the market hasn’t recovered.

Wall Street experts have been warning that AI stocks were getting too expensive compared to their real-world profits. Now that caution is becoming reality. Risky trades tied to AI and crypto are no longer offering guaranteed rewards. Money is still flowing in, but not like before.

Palantir is a good example of how sentiment has changed. Even though it reported strong earnings, its stock fell 8% the next day. This shows that even crowd favorites are vulnerable when expectations are sky-high. According to behavioral economics professor Peter Atwater, Palantir sits right alongside AI and crypto in investors’ minds—these trades all rely on intense public confidence.

We’re not seeing a total collapse, but there’s a clear shift. Some high-risk trades that were once booming are now falling apart. For example, an ETF tied to Meta dropped 8.5% this week, while another focused on Palantir lost 22%. A tech innovation ETF fell over 20%, and trades involving Super Micro Computer also stumbled.

The major tech players—known as the “Magnificent Seven”—fell about 3% as investors started questioning their big spending on AI projects. A comment from OpenAI’s CFO about possible government support for AI funding made some people even more nervous.

Atwater says we’re seeing a turn in mood. As excitement fades, skepticism is growing. If this continues, markets may not bounce back as easily as they did before.

Meme stocks, unprofitable tech firms, and recent IPOs all pulled back over the past week. An ETF tracking new market entries fell 5%, the worst drop since September. Another ETF filled with unprofitable tech names fell 7%, its biggest slide since August.

Crypto-related ETFs have also seen massive outflows. In just one week, over $700 million was pulled out—$600 million from BlackRock’s Bitcoin fund and $370 million from its Ether product. Tokens like Solana and Dogecoin have dropped double digits since their recent launches. Even the new MEME ETF is down over 20% since its debut just a month ago.

Investors are getting nervous. Stephen Kolano from Integrated Partners says people are cashing out of the trades that have run up the most—mostly those tied to AI and crypto.

This shift could have broader effects. Retail investors helped push markets higher earlier this year despite other economic pressures. But now that riskier trades are losing steam and cash is being pulled out, liquidity may be drying up at the edges.

Still, this isn’t a full-blown crash. The S&P 500 is only down about 2% from recent highs. But for many investors who believed everything would keep going up, this week feels different. Timing matters again, and leverage—borrowing to invest—can hurt just as much as it helps.

Bitcoin’s recent 15% drop is raising eyebrows not just for how much it fell, but when it happened. Some analysts now see Bitcoin as an early warning sign for high-risk tech stocks and retail investor activity. Citi reports that large holders of Bitcoin—so-called whales—are starting to sell. These investors usually hold through tough times, so their exit is especially worrying.

Bitcoin trades around the clock, making it a powerful signal for market sentiment. Eric Balchunas from Bloomberg Intelligence says it acts like a nonstop price-check system because traders are always online and reacting fast.

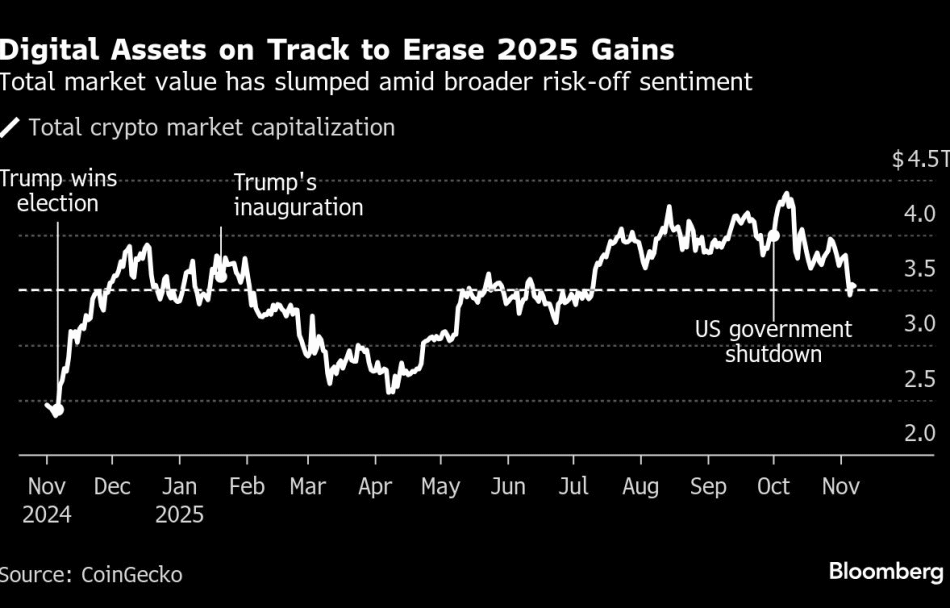

The decline is even more surprising given how much political support crypto has gained recently. Earlier this year, Bitcoin got a boost from Donald Trump’s push to make the U.S. a leader in crypto innovation. But after peaking at around $4.4 trillion in October, the total value of all digital tokens has dropped nearly 20%, erasing most of this year’s gains.

For those who thought clearer regulations would spark a new crypto boom, this rapid reversal has been tough to watch. Ilan Solot from Marex says there just isn’t enough new money coming in to replace those exiting the market. Many investors are burned out—financially and emotionally—and can’t handle another rough crypto cycle.

To turn things around, big holders need to stop selling, and ETF flows need to stabilize. Until then, riskier parts of the market may continue to struggle.