Markets Rebound as Futures Rise, Natural Gas Soars 25%

**Markets Rebound After Steep Drop, Futures Point Higher**

Stock futures are climbing Thursday morning after a strong bounce-back session on Wednesday. This comes just one day after Wall Street experienced its worst single-day drop since October. Early in the day, stocks were down, but sentiment shifted dramatically after President Trump addressed the World Economic Forum in Davos. When he clarified that the U.S. has no plans to use military force in relation to Greenland, investor nerves calmed and markets rallied into the close.

Here’s how the major indexes ended the day:

– **Dow Jones Industrial Average** surged 1.21% to 49,077

– **S&P 500** rose 1.1% to 6,875

– **Nasdaq Composite** gained 1.18%, closing at 23,224

– **Russell 2000**, which tracks small-cap stocks and is leading all major indexes in 2026 with a year-to-date gain of 6.1%, jumped 2% to finish at 2,698

—

**Treasury Yields Show Mixed Movement**

The bond market saw mixed action following two days of intense selling that pushed yields to multi-month highs. Short-term Treasury bills continued facing pressure from sellers, while demand returned for longer-term notes and bonds. The easing of geopolitical concerns helped stabilize the market.

– **10-year Treasury yield** settled at 4.25%

– **30-year Treasury bond** closed at 4.87%

—

**Energy Prices Up—Natural Gas Soars**

Energy markets moved higher overall, but natural gas stole the spotlight with a huge price spike.

– **Natural gas** skyrocketed by nearly 25% to $4.88, marking a two-day jump of almost 50%. This sharp rise was fueled by:

– Traders covering short positions

– A powerful winter storm moving in from Canada

– Rising demand from data centers supporting AI and cloud computing

Meanwhile, oil prices also edged up:

– **Brent Crude** rose 0.59% to $65.30

– **West Texas Intermediate (WTI)** increased 0.43% to $60.62

—

**Gold Keeps Climbing, Silver Stalls**

Gold prices continued their upward trend, driven by ongoing global uncertainties, strong central bank buying, and retail investor interest.

– **Gold** closed at $4,831, up 1.45%

– **Silver**, however, remained flat at $92.61 as it struggles near the key $100 level

—

**Cryptocurrencies Drop Amid Global Tensions**

Crypto markets pulled back sharply as growing tensions between the U.S. and Europe triggered risk-off sentiment among investors. The drop highlights how sensitive digital assets remain to global economic shifts.

– **Total crypto market cap** fell by about 2.4% to $3.1 trillion

– Most top tokens saw losses—92 out of the top 100 coins were in the red

– **Bitcoin** was trading at $89,945 as of 8 a.m. EST

– **Ethereum** was at $2,985

—

**Top Stock Analyst Ratings for January 22, 2026**

Wall Street analysts issued several key stock upgrades and downgrades that could impact investor decisions.

**Upgrades:**

– **Alphabet (GOOGL)** upgraded to Strong Buy at Raymond James; price target raised to $400 from $315

– **Callaway Golf (CALY)** moved to Buy at B. Riley; price target increased to $19 from $11

– **Datadog (DDOG)** upgraded to Buy by Stifel despite lower target of $160 (down from $205)

– **Sphere Entertainment (SPHR)** upgraded to Buy by BTIG with a $110 target

– **Texas Instruments (TXN)** raised to Neutral from Underperform at BNP Paribas; new target is $190

**Downgrades:**

– **Amicus Therapeutics (FOLD)** downgraded to Hold at Jefferies; target trimmed to $14.50 from $16

– **Chemed (CHE)** downgraded to Hold at Jefferies; price target cut to $475 from $550

– **Hyatt Hotels (H)** lowered to In Line at Evercore ISI; target raised slightly to $175 from $170

– **LCI Industries (LCII)** downgraded to Hold by Loop Capital; price target set at $149

– **Legend Biotech (LEGN)** downgraded sharply to Hold from Buy by TD Cowen; target slashed from $62 to $21

Keep an eye on how these moves influence stock prices throughout the trading day.

Galaxy Digital Launches $100M Crypto Hedge Fund

Galaxy Digital, the crypto investment firm led by Mike Novogratz, has raised $100 million for a brand-new hedge fund that’s set to launch in early 2026. The fund is backed by family offices, wealthy individuals, and institutional investors who are betting on the future of digital finance.

This new hedge fund marks a return to Novogratz’s original vision for Galaxy Digital, which started out as a hedge fund nearly a decade ago. Over the years, the company evolved into a major player in digital asset management and investment banking. Today, Galaxy Digital manages around $17 billion in digital assets and continues to grow despite market ups and downs.

The fund will use a split investment strategy. About 30% of the money will go directly into cryptocurrencies like Bitcoin, Ethereum, and Solana. The other 70% will be invested in financial companies that are being changed or disrupted by blockchain technology, artificial intelligence, and new regulations. This includes both winners and losers in the digital finance world.

One key feature of this hedge fund is that it will use both long and short positions. That means it can make money whether prices go up or down. This flexible strategy is designed to take advantage of the often-volatile crypto markets.

The fund is being run by Joe Armao, who says it’s all about finding opportunities in companies that are either thriving or struggling because of tech changes in finance. He also believes Bitcoin and other major cryptocurrencies still have strong potential, especially if the U.S. Federal Reserve continues cutting interest rates.

The launch comes at a time when the crypto market is experiencing big swings. Bitcoin is currently trading near $90,000 but has dropped about 28% from its high in October. Even with this volatility, Galaxy Digital reported an impressive $505 million profit in the third quarter of 2025.

Galaxy Digital’s stock is currently trading at $31.72, slightly down by 1.19%. Although the fund has already secured $100 million in commitments, there’s a possibility they might accept more investors going forward.

Unlike typical crypto funds that just hold digital coins and wait for them to go up, this new hedge fund is built to handle both good times and bad. By including traditional financial stocks and taking short positions when needed, it aims to deliver returns no matter what the market is doing.

Key terms: Galaxy Digital, crypto hedge fund, Mike Novogratz, Bitcoin, Ethereum, Solana, blockchain investments, financial services disruption, digital asset management, long and short strategy, market volatility, institutional crypto investing.

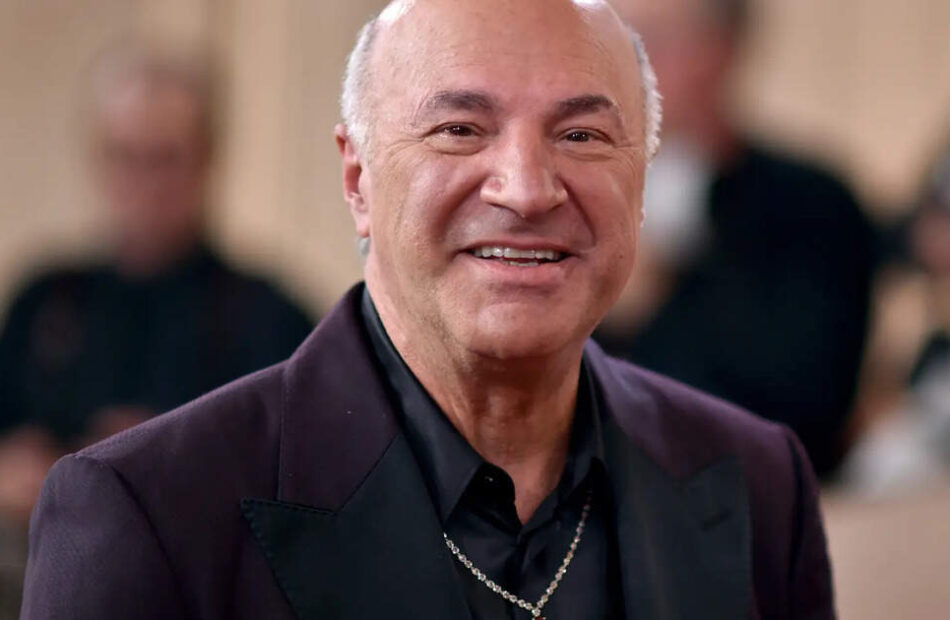

Kevin O’Leary Bets on Crypto, AI Land Infrastructure

Kevin O’Leary, known from Shark Tank and a long-time supporter of cryptocurrency, is changing how he invests in the space. Instead of buying more crypto tokens, he’s turning his attention to something much bigger—crypto and AI infrastructure.

O’Leary has now acquired 26,000 acres of land in North America. This includes 13,000 acres in Alberta, Canada, and another 13,000 acres in other undisclosed regions that are currently going through permit approvals. His goal is to use this land to support energy-heavy operations like Bitcoin mining and large data centers. Over time, he also sees this land powering massive AI systems and cloud computing infrastructure.

Rather than build the data centers himself, O’Leary plans to lease out the land and power to companies that need it. Think of it like real estate development—but instead of homes or offices, he’s preparing sites for tech companies to plug in and run their systems. He’s focusing on making the land “shovel-ready” by ensuring it has everything businesses need: electricity, water, internet fiber lines, and even air rights for drones or future tech.

For O’Leary, access to affordable power is a huge opportunity. In some cases, he says, power contracts offering electricity below six cents per kilowatt-hour are more valuable than Bitcoin itself. That’s because without cheap energy and ready-to-go infrastructure, many of the data centers companies have announced in recent years simply won’t get built.

When it comes to actual cryptocurrencies, O’Leary is sticking with only two: Bitcoin and Ethereum. He believes these are the only two digital assets that matter for serious investors. In his view, the rest of the market—what he calls “poopoo coins”—are down 60% to 90% from their highs and are unlikely to recover.

He also points out that crypto-focused ETFs (exchange-traded funds) don’t play a big role in the broader financial world. According to O’Leary, if you want exposure to nearly all of the movement in the crypto market, owning just Bitcoin and Ethereum covers over 97% of the market’s total volatility.

Data from investment firm Charles Schwab backs this up, showing that about 80% of crypto’s $3.2 trillion value is tied up in just those two coins.

In summary, Kevin O’Leary’s crypto strategy is all about long-term infrastructure. He’s betting big on land and power for Bitcoin mining, AI development, and data centers. And when it comes to actual cryptocurrencies, he’s only putting his trust—and money—into Bitcoin and Ethereum.

GE Aerospace Stock Falls Despite Strong Q4 and Outlook

**GE Aerospace Stock Drops Despite Strong Q4 Earnings and Positive Outlook for 2026**

GE Aerospace stock took a hit on Thursday, falling over 6%, even though the company reported strong fourth-quarter results and gave an optimistic forecast for 2026. Investors are worried that the company’s fast growth might be slowing down, which may have triggered the stock drop.

In the fourth quarter, GE Aerospace posted a net profit of $2.85 billion, or $2.40 per share. That’s up from $2.29 billion, or $1.75 per share, during the same period last year. Adjusted earnings per share came in at $1.57, beating analyst expectations by $0.14. Revenue also impressed, rising 20% year-over-year to reach $11.87 billion.

The company saw a major increase in new orders during the quarter. Total orders jumped 74% to $27 billion, and GE’s backlog of work now stands at around $190 billion. Orders in its commercial segment surged 76%, while defense orders climbed 61%, showing strong demand in both areas.

Revenue from commercial engines and services rose 24% to $9.46 billion, higher than the expected $8.95 billion. Revenue from defense and propulsion technology also went up 13%, hitting $2.84 billion and beating forecasts of $2.63 billion.

Looking ahead, GE Aerospace expects steady growth, but at a slower pace than before. For 2025, the company expects adjusted revenue to grow by 20.5%, reaching $42.3 billion. In 2026, that growth is expected to slow to low double digits. GE is forecasting full-year adjusted earnings between $7.10 and $7.40 per share for 2026—higher than most analysts predicted. The company also expects to generate adjusted free cash flow between $8 billion and $8.4 billion.

Breaking it down by business segment, commercial engines and services revenue is expected to grow in the mid-teens percentage range in 2026, down from 24% in 2025. Defense and propulsion revenue is expected to rise by a mid- to high-single-digit percentage, compared to 11.4% growth last year.

Despite the slowdown in growth projections, analysts like JP Morgan’s Seth Seifman still rate the stock positively. However, he warned that GE might face challenges expanding its profit margins in 2026 due to issues like the ramp-up of the GE9X engine program and changes in demand for spare parts.

GE Aerospace CEO Larry Culp remains confident about the future, saying the company is well-positioned for another strong year of earnings and cash flow growth. He pointed to continued strong demand for air travel, which drives the need for spare parts and maintenance services.

**Key Highlights:**

– **Q4 Profit:** $2.85 billion or $2.40 per share

– **Adjusted EPS:** $1.57 (beat expectations by $0.14)

– **Revenue:** Up 20% year-over-year to $11.87 billion

– **Orders:** Total orders rose 74% to $27 billion; backlog at ~$190 billion

– **2026 Forecast:** Earnings of $7.10–$7.40 per share; free cash flow of $8–$8.4 billion

– **Growth Outlook:** Slower growth expected in both commercial and defense segments

Even with slower growth ahead, GE Aerospace continues to benefit from strong industry trends and global demand for aviation services, making it a company to watch closely in the coming years.

Husky Inu AI (HINU) Prepares for Token Price Increase

**Husky Inu AI (HINU) Set to Increase Token Price Again**

Husky Inu AI (HINU) is preparing for another price bump in its pre-launch phase. The token’s value is set to go up from $0.00025539 to $0.00025636. This small but steady increase is part of a planned strategy to raise funds and support ongoing development. These gradual price increases also reward early investors and help grow the project’s community.

The pre-launch phase started on April 1, 2025, right after the presale ended. The official launch of Husky Inu AI is scheduled for March 27, 2026. However, the team has said this date could be moved depending on progress. So far, two review meetings have taken place—on July 1 and October 1, 2025—with another planned for January 1, 2026.

Fundraising has picked up lately after a brief slowdown. Husky Inu AI has already raised over $922,000 and may pass the $1 million mark before launch. The funds are being used to improve the platform, expand marketing efforts, and build a broader ecosystem around the HINU token.

**Crypto Market Sees Small Gains as Global Tensions Ease**

The overall cryptocurrency market saw a slight rebound recently. Bitcoin (BTC), Ethereum (ETH), and other major coins gained a bit of ground as political tensions cooled. This improvement came after President Trump reversed his recent threats to impose tariffs on European countries. His change of heart followed intense diplomatic talks at the World Economic Forum in Davos.

Trump’s initial remarks over the weekend had caused concern, as he hinted at taking control of Greenland and imposing new trade barriers. However, he later softened his stance, saying a future deal with NATO could address the situation. He also decided to delay the proposed tariffs.

With this shift in tone, market fears eased, and crypto prices began to recover. The total market cap rose 0.87% to $3.04 trillion. Bitcoin climbed 0.72% to $89,803, while Ethereum went up 1% to $2,994. Ripple (XRP) saw a stronger bounce, rising over 2% as it aims to push past the $2 mark.

Other top performers included Solana (SOL), up 1.50%, and Dogecoin (DOGE), which added 1% to trade at around $0.125. Cardano (ADA), Chainlink (LINK), Stellar (XLM), Hedera (HBAR), Toncoin (TON), and Polkadot (DOT) also posted gains. However, Litecoin (LTC) slipped by 0.50%, going against the overall trend.

**Crypto Regulation Bill Delayed as Focus Shifts**

In Washington, progress on a new crypto market structure bill has been delayed. The Senate Banking Committee has postponed its review of the bill for several weeks. One major reason is that Coinbase pulled its support for the proposal.

Sources say that both committee Republicans and the White House want the crypto sector and banking industry to agree on key parts of the bill—especially those dealing with stablecoin yields—before moving forward.

Meanwhile, attention in Congress has shifted to housing issues. President Trump recently urged big investors to step back from buying residential properties in order to lower housing costs for average Americans.

**Stay Connected With Husky Inu AI**

Want to keep up with Husky Inu AI? Check out their official platforms:

– Website: [Husky Inu Official Website]

– Twitter: [Husky Inu Twitter]

– Telegram: [Husky Inu Telegram]

_Disclaimer: This content is for informational purposes only and should not be taken as financial or investment advice._