Bitmine Boosts ETH Holdings, Eyes $374M Staking Revenue

Bitmine Immersion Technologies is making major moves in the Ethereum space. Last week alone, the company added 32,977 ETH to its holdings, pushing its total stash to an impressive 4.1435 million ETH. That means Bitmine now holds about 3.43% of all Ethereum in circulation. Alongside this, the company also owns 192 Bitcoin and has $915 million in cash reserves, bringing its total digital and fiat assets to $14.2 billion.

The company is not just buying ETH—it’s putting it to work. Bitmine staked 250,592 ETH in the past week, bringing its total staked ETH to 659,219, worth about $2.1 billion at current prices. This shows that Bitmine is not only holding Ethereum but also earning income through staking rewards.

Bitmine is planning to launch its own staking network called MAVAN (Made in America Validator Network) by 2026. This system will manage all of the company’s Ethereum staking activities and is expected to bring in $374 million per year in staking revenue. Bitmine uses a metric called CESR (Current Effective Staking Rate), which it estimates at 2.81%, to calculate potential income from staking.

Chairman Thomas Lee emphasized that Bitmine will continue aggressively acquiring Ethereum. The company wants to stay ahead of competitors like SharpLink, The Ether Machine, Bit Digital, and Coinbase, all of which hold significantly less ETH.

To support future growth, Bitmine is asking shareholders to vote on increasing the number of authorized shares. This would give the company more flexibility for future moves like stock splits or acquisitions. The vote will happen during the Annual Meeting on January 15 at the Wynn Las Vegas. The agenda includes electing eight board members and approving a new incentive plan for 2025. There will also be a vote on performance-based compensation for Lee.

Bitmine’s stock is getting a lot of attention on Wall Street. It has an average daily trading volume of $980 million, placing it among the top 50 most-traded U.S. stocks—right between IBM and Home Depot. Both institutional and retail investors are showing strong interest.

As Ethereum becomes more popular—especially among younger generations and in the growing AI industry—Bitmine sees big opportunities ahead. The company plans to continue expanding its ETH holdings and improving its staking income, all while staying focused on increasing value for shareholders.

In short, Bitmine is betting big on Ethereum, and so far, it’s paying off.

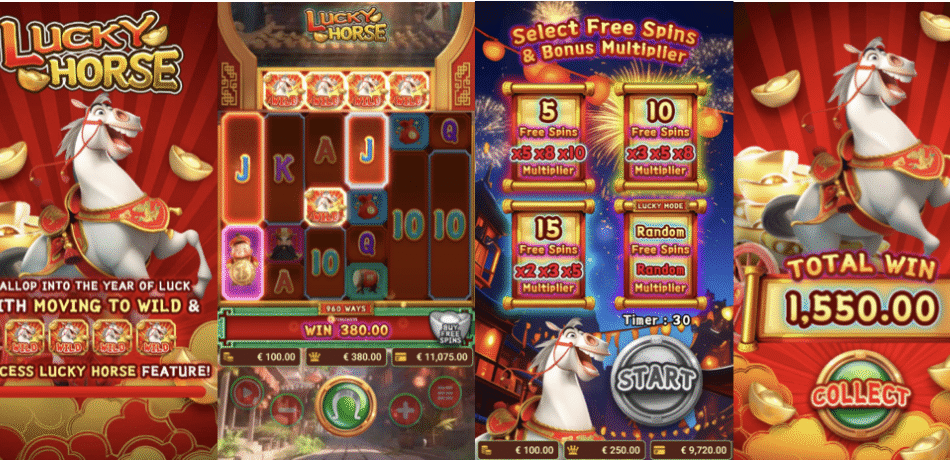

Lucky Horse Game Announcement Asia by SpadeGaming

Lucky Horse

Release Date:13th January 2026

RTP 96.29% / Volatility: Medium

Game Description

Gallop into the Year of Luck with Moving To Wild & Success Lucky Horse Feature!

- MOVING TO WILD

- Win-related silver frame symbols will transform into gold frame symbols, then WILD in the following win!

- FREE GAME FEATURE

- 4 or more SCATTER symbols trigger the Free Game Feature.

- SUCCESS LUCKY HORSE FEATURE

- When the horse fully fills the top cart reel, it will turn into 4 WILD symbols!

Game Features

- 6 reel game with up to 32400 ways to win

- 4 or more SCATTER symbols trigger Free Game feature

- Extra WILD from Moving To WILD

- Win Free Spins & Bonus Multiplier in Free Game

Evolve Finalizes 2025 ETF Year-End Distributions

**Evolve Funds Confirms Final 2025 Year-End Distributions**

Evolve Funds Group Inc., one of Canada’s leading ETF providers with over $8 billion in assets under management, has officially released the final year-end cash and non-cash distributions for several of its ETFs for the 2025 tax year. This update corrects a previous version that incorrectly labeled some data as “estimated” instead of “final.” All other information, including the amount of each distribution, remains unchanged.

### What Investors Need to Know

These distributions include:

– **Cash Income Distributions**: Real money paid to investors.

– **Non-Cash (Reinvested) Income and Capital Gains**: These are automatically reinvested into additional units of the same fund and consolidated immediately, so the number of units held remains the same post-distribution.

### Important Dates

– **Record Date**: December 31, 2025. You must be holding the fund on this date to receive the distribution.

– **Payment Date**: Around January 8, 2026.

– **Tax Reporting**: Actual taxable amounts and their breakdown (income vs. capital gains) will be reported through CDS Clearing and Depository Services Inc. in early 2026.

### Distribution Highlights

Some key ETFs with notable year-end non-cash capital gains distributions include:

– **Evolve Bitcoin ETF (EBIT)**: $8.06606 per unit in capital gains.

– **Evolve Levered Ether ETF (LETH)**: $15.45171 per unit in capital gains.

– **Evolve Solana ETF (SOLA)**: $1.71345 per unit in capital gains, plus $0.19817 reinvested income.

– **Evolve FANGMA Index ETF (TECH.B)**: $2.20008 per unit in capital gains.

– **Evolve Cyber Security Index Fund (CYBR)**: $1.33020 per unit in capital gains.

Most other funds reported no income or capital gains distributions for the year. A few funds, such as the High Interest Savings Account Fund (HISA), showed small reinvested and cash income payouts.

### Understanding the Impact

These distributions do not affect your number of units or their market value directly, but they do have tax implications. Non-cash distributions increase your adjusted cost base (ACB), which affects capital gains or losses when you sell your ETF units. It’s important for investors to keep track of these figures for accurate tax reporting.

### Where to Learn More

For full details on distribution amounts across all ETFs, visit [www.evolveetfs.com](http://www.evolveetfs.com). The site also provides easy access to fund-specific data, tax documents, and more information on Evolve’s wide range of ETFs, including those focused on sectors like artificial intelligence, blockchain, cybersecurity, cryptocurrency, and fixed income strategies.

### Quick Reminder for ETF Investors

Investing in ETFs comes with management fees, expenses, and possible brokerage costs. These products are not guaranteed and can fluctuate in value. Always review the fund’s prospectus to understand potential risks before investing.

### Stay Informed

Evolve continues to lead with innovative ETF products tailored for today’s investor. Whether you’re looking for thematic growth opportunities or enhanced income solutions, Evolve offers access to some of the most dynamic sectors and global strategies.

Visit Evolve’s website or follow them on X, LinkedIn, Facebook, and YouTube for the latest updates on performance, new fund launches, and market insights.

### Legal Disclaimers

Indexes like the S&P 500 and NASDAQ used by Evolve ETFs are licensed from third parties such as S&P Dow Jones Indices and Nasdaq Inc. These providers do not sponsor or promote Evolve ETFs and are not responsible for their performance. Investing directly in an index is not possible; ETFs attempt to track these benchmarks but do not guarantee returns.

Always consult a financial advisor or tax professional before making investment decisions based on distribution data.

Crypto Weekly: Hacks, DJT Token, Coinbase Plans & More

**Crypto Weekly Recap: Hacks, Bets, Tokens, and Market Shifts**

Here’s everything you need to know from this week in crypto—from mysterious wallet hacks and falling phishing scams to a $50,000 lost bet on Ether and new moves from Coinbase and Trump Media.

—

### Hundreds of Ethereum Wallets Hacked in Strange Attack

A mysterious hacker has drained funds from hundreds of wallets across Ethereum Virtual Machine (EVM) networks. Each wallet lost small amounts—typically under $2,000—but the scale of the attack is wide, impacting wallets on multiple chains.

Crypto sleuth ZachXBT and cybersecurity firms believe this was a broad, automated phishing attack. One potential culprit? A fake email pretending to be from MetaMask. Experts recommend users check and revoke any smart contract permissions they may have unknowingly approved.

**Keywords:** EVM wallet hack, MetaMask phishing, smart contract approval, Ethereum wallet exploit

—

### Coinbase Plans Big Expansion for 2026

Coinbase is shifting gears. CEO Brian Armstrong said the company will focus on stablecoins, its Ethereum Layer-2 network “Base,” and building out its platform beyond crypto trading. The goal? To become an “everything exchange.”

Coinbase recently added stock trading, prediction markets, and rebranded its wallet app as an “everything app,” which now includes social and onchain features. It’s all part of a push to compete with other crypto exchanges trying to become all-in-one super apps.

**Keywords:** Coinbase Base, stablecoins, everything exchange, prediction markets, crypto super app

—

### Bitcoin Whale Buying is Overhyped, Says CryptoQuant

Rumors that Bitcoin whales are buying up large amounts are being overstated, according to data firm CryptoQuant. The activity being seen on-chain mostly comes from crypto exchanges moving funds around—not real investors making big buys.

These internal transfers can make it look like large wallets are accumulating Bitcoin, but it’s just normal exchange behavior. The structure of the Bitcoin market hasn’t changed as much as people think.

**Keywords:** Bitcoin whales, whale accumulation myth, exchange wallet movement, CryptoQuant data

—

### BitMine Wants to Issue 50 Billion Shares

BitMine’s chairman Tom Lee wants to raise the company’s authorized shares from 50 million to 50 billion. Why? He believes Ether’s price could skyrocket—possibly reaching $250,000 if Bitcoin hits $1 million—and that would push BitMine’s stock too high for average investors.

BitMine switched from Bitcoin mining to focusing on Ether in 2025 but still holds some Bitcoin operations. The proposed stock increase would make room for future stock splits to keep shares affordable.

**Keywords:** BitMine share increase, Ether price prediction, ETH treasury strategy, Tom Lee proposal

—

### SEC Commissioner Crenshaw Steps Down

Caroline Crenshaw, the only Democrat currently serving as an SEC commissioner, is stepping down after more than five years. Her departure leaves the financial regulator with only Republican commissioners.

Crenshaw has often pushed for stricter rules on crypto and was against the SEC’s settlement with Ripple. She warned that weak crypto regulations could lead to major market disruptions.

**Keywords:** SEC commissioner resignation, Caroline Crenshaw, Ripple case, US crypto regulation

—

### Trump Media to Launch DJT Token for Shareholders

Trump Media & Technology Group announced plans to launch a blockchain token named DJT. Every shareholder will get one token per share they own. The token may offer perks like discounts on Truth Social and other Trump Media platforms.

However, the DJT token won’t give holders any ownership rights or profit claims. It’s more like a rewards program than a tokenized stock.

**Keywords:** Trump Media DJT token, Truth Social crypto reward, blockchain shareholder perks

—

### Market Update: Winners and Losers

At week’s end:

– **Bitcoin (BTC):** $90,029

– **Ether (ETH):** $3,107

– **XRP:** $2.00

– **Total Market Cap:** $3.07 trillion

**Top Altcoin Gainers:**

– MYX Finance (MYX): +89.50%

– Pepe (PEPE): +48.55%

– Canton (CC): +41.12%

**Top Altcoin Losers:**

– Lighter (LIT): -4.66%

– Monero (XMR): -4.52%

– Mantle (MNT): -4.50%

**Keywords:** crypto market cap, Bitcoin price update, altcoin winners and losers

—

### Notable Quotes This Week

– “Decentralization erodes not through capture, but through convenience.” — Vitalik Buterin

– “Risk/Reward is the best it has ever been.” — Brian Rose

– “ETFs and institutions don’t trade like hype-driven retail.” — Armando Pantoja

– “Pakistan could become a crypto leader in five years.” — CZ Zhao

– “The Fed is quietly easing again. That’s good for Bitcoin.” — Bill Barhydt

**Keywords:** crypto market sentiment, decentralization risks, institutional investors in crypto

—

### Phishing Scams Drop 83% in 2025

Crypto phishing scams linked to wallet drainers dropped dramatically in 2025. Total losses fell to $83.85 million—an 83% drop from nearly $500 million in 2024.

The number of victims also dropped by 68%, according to Web3 security firm Scam Sniffer. However, phishing attacks haven’t disappeared entirely—they still spike during bull runs when user activity is high.

The third quarter of 2025 saw the highest losses at $31 million due to Ether’s rally during that time.

**Keywords:** crypto phishing drop, wallet drainer scams, Scam Sniffer report, Ethereum security threats

—

### $50K Lost on Failed Ether Price Bet

Kain Warwick, founder of Synthetix and Infinex, lost a $50,000 bet after predicting Ether would hit $25,000 by the end of 2025. Instead, ETH ended the year around $2,980—a far cry from the target.

The bet happened after a conversation with Multicoin’s Kyle Samani in November. Warwick placed a high-risk wager with 10:1 odds that ETH would rally big—clearly a miscalculation.

**Keywords:** Kain Warwick Ether bet, ETH price prediction fail, crypto wagers

—

### Crypto Sentiment Improving But Still Cautious

The popular Fear & Greed Index climbed out of “extreme fear” territory this week with a score of 29—the highest in three weeks. While still cautious, the rise suggests investors may be warming up again after weeks of negative sentiment.

Bitcoin hovered just below $90K during this sentiment shift. Some analysts believe the prolonged fear period could signal a buying opportunity.

**Keywords:** crypto sentiment index, fear and greed index, Bitcoin investor mood

—

### Top Reads This Week

– **Crypto Laws in 2025 & What’s Coming in 2026:** From stablecoin laws in the US to MiCA regulations in Europe.

– **Weirdest AI Moments of 2025:** Nine strange but true stories from AI’s wild ride this year.

**Keywords:** crypto regulation update 2026, AI weird stories 2025

—

Stay tuned as we head into another big year for crypto!

Crypto Weekly: Wallet Hacks, Coinbase Plans & DJT Token

**Crypto Weekly Recap: Wallet Hacks, Coinbase Plans, Bitcoin Myths & More**

Here’s a breakdown of the biggest crypto news and trends from this week. From wallet hacks to new product strategies and surprising market moves, here’s what you need to know:

—

### Hundreds of EVM Wallets Drained in Ongoing Mystery Attack

A mysterious attack has quietly drained hundreds of wallets across Ethereum-compatible (EVM) chains. According to onchain analyst ZachXBT, the attacker is stealing small amounts from each wallet—usually under $2,000.

The attack is likely automated and affecting wallets across multiple blockchains, not just one. Cybersecurity researcher Vladimir S. suggested it may have started from a fake email pretending to be from MetaMask. Hackless, a Web3 security firm, advises users to revoke smart contract permissions and monitor their wallet activity closely.

**Key keywords:** EVM wallet hack, MetaMask phishing, Web3 security, small-scale exploit

—

### Coinbase Focuses on Stablecoins, Base Network & Broader Exchange Vision for 2026

Coinbase CEO Brian Armstrong shared the company’s long-term plans this week. By 2026, Coinbase wants to go beyond crypto trading. It’s doubling down on:

– **Stablecoins**

– **Ethereum Layer 2 network (Base)**

– **An “everything exchange”** that includes stocks, prediction markets, and even commodities.

The company has already started offering stock trading and rebranded its wallet app to include social and onchain features. Coinbase is moving toward becoming an all-in-one financial platform.

**Key keywords:** Coinbase strategy, Base network, stablecoins, everything exchange

—

### No, Bitcoin Whales Aren’t Buying Big—CryptoQuant Debunks Rumors

There’s a popular idea floating around that big investors (Bitcoin whales) are loading up on BTC again—but it’s not true. CryptoQuant says what looks like whale buying is actually just exchanges moving customer funds between wallets.

These transfers make it seem like big accounts are accumulating, but it’s just normal operations behind the scenes. This shows why it’s important to understand how onchain data works before jumping to conclusions.

**Key keywords:** Bitcoin whale accumulation, CryptoQuant data, exchange wallet activity

—

### BitMine Chairman Pushes for Massive Share Expansion

Tom Lee, the chairman of BitMine (a public ETH treasury company), wants to increase the company’s authorized shares from 50 million to 50 billion. Why? He believes Ether could hit $250,000 if Bitcoin reaches $1 million.

If that happens, BitMine’s stock could become too expensive for regular investors. The share increase would allow for future stock splits to keep prices accessible.

**Key keywords:** BitMine share proposal, ETH price prediction, stock split planning

—

### SEC’s Only Democrat Commissioner Leaving – All Eyes on Crypto Regulation

Caroline Crenshaw, the only Democrat on the U.S. SEC, is stepping down after five years. Her exit leaves the commission with only Republican members—for now.

Crenshaw was a known critic of how the SEC handled crypto cases like Ripple Labs. She warned that weakening oversight could lead to wider market problems.

**Key keywords:** SEC crypto policy, Caroline Crenshaw resigns, Ripple case stance

—

### Trump Media Announces DJT Token for Shareholders

Trump Media & Technology Group is launching a blockchain-based token called DJT. Each shareholder will get one token per share owned.

These tokens won’t represent ownership or profits but may offer rewards like discounts on Truth Social and other Trump Media services. The token launch is being done with Crypto.com.

**Key keywords:** DJT token, Trump Media blockchain rewards, Truth Social perks

—

### Market Update: Bitcoin Nears $90K as Altcoins Rally

Crypto markets are strong this week:

– **Bitcoin (BTC):** $90,029

– **Ethereum (ETH):** $3,107

– **XRP:** $2.00

– **Total Market Cap:** $3.07 trillion

**Top Gainers:**

– MYX Finance (MYX): +89.50%

– Pepe (PEPE): +48.55%

– Canton (CC): +41.12%

**Top Losers:**

– Lighter (LIT): -4.66%

– Monero (XMR): -4.52%

– Mantle (MNT): -4.50%

**Key keywords:** crypto market cap, Bitcoin price today, altcoin winners and losers

—

### Best Quotes of the Week

– “This bear market drawdown is only about 55%, much less than past ones at 70–80%.” — Julio Moreno, CryptoQuant

– “Decentralization fades not by force, but by convenience.” — Vitalik Buterin

– “Fed easing is back. That’s bullish for all assets—including Bitcoin.” — Bill Barhydt

– “Institutions now drive markets—this isn’t 2016 anymore.” — Armando Pantoja

– “Pakistan could be a global crypto leader in five years.” — CZ, Binance

– “Despite setbacks, community engagement is rising.” — Santiment

**Key keywords:** crypto sentiment quotes, Bitcoin predictions, decentralization risks

—

### Top FUD Stories: Fear and Uncertainty in Crypto This Week

#### Phishing Losses Drop 83% in 2025—but Attacks Still Happen

Phishing scams using wallet drainers caused $83.85 million in losses in 2025—a major drop from nearly $500 million in 2024. Victim count also dropped by 68%.

However, these scams still spike during busy market periods. August and September were particularly bad due to ETH’s rally.

**Key keywords:** crypto phishing attacks 2025, wallet drainer scams, Scam Sniffer report

#### Synthetix Founder Loses $50K Bet on ETH Hitting $25K

Kain Warwick lost a high-profile bet after predicting Ethereum would hit $25K by the end of 2025. It closed the year around $2,980 instead.

The bet was made with Multicoin’s Kyle Samani at 10:1 odds—and Warwick now owes $50K.

**Key keywords:** ETH price prediction fail, Kain Warwick bet, Ethereum price history

#### Crypto Fear Index Rises—Sentiment Improving Slowly

After weeks of extreme fear in the market, sentiment indicators are finally turning more positive. The Fear & Greed Index hit its highest level in over 20 days.

Analysts say this shift might be the start of a new rally phase as risk/reward becomes more attractive again.

**Key keywords:** crypto fear index update, Bitcoin sentiment shift, market recovery signs

—

### Must-Read Stories from the Magazine

– **Crypto Laws Update: How Regulations Changed in 2025 & What’s Coming in 2026**

Learn how U.S. stablecoin laws and Europe’s MiCA rollout are shaping the future of crypto.

– **9 Weirdest AI Moments of 2025**

From talking robots to questionable deepfakes—AI had a wild year too.

—

Stay tuned for more updates as the crypto space continues to evolve fast—with new players entering and old narratives breaking down.