Interns Embrace AI, Hesitate on Crypto and Robots

**Interns Are Big Fans of AI, Still Unsure About Crypto and Humanoids**

A new survey shows that artificial intelligence (AI) is extremely popular among finance interns. In the U.S., 96% of interns are already using AI tools, while 91% in Europe say the same. Most agree that AI helps them save time and is easy to use. But even though it’s helpful, 88% say AI still needs to get better at being accurate.

This aligns with what’s happening on Wall Street, where major tech companies—often called the “Magnificent 7″—are set to invest $650 billion this year in research and development, including AI projects.

**Crypto Still Has a Long Way to Go**

Even though Bitcoin (BTC) has passed $100,000 in value and is now a part of many Wall Street portfolios thanks to spot Bitcoin ETFs, most finance interns still aren’t jumping on the crypto bandwagon. Only 18% say they own or use digital assets like cryptocurrencies. That’s up slightly from 13% last year.

Interest is slowly growing: 26% of interns say they are curious about digital currencies, compared to 23% last year. However, a majority—55%—still say they don’t care about crypto, although that’s down from 63% last year.

This lack of interest stands out because Bitcoin ETFs have already collected over $53.7 billion in investments, and Ethereum ETFs have attracted $12.4 billion. Many large companies are also adding cryptocurrencies like Bitcoin and Ethereum to their balance sheets. Ethereum (ETH) recently hit an all-time high of over $4,800.

**Humanoids Are Cool but Raise Concerns**

The survey also explored how interns feel about humanoid robots—robots designed to look and act like humans. More than 60% of U.S. interns and nearly 70% of European interns say they’re interested in having a humanoid robot at home. They believe these robots will have useful roles and could take over many human jobs.

However, not everyone is optimistic about the impact of humanoids on society. Only 36% of U.S. interns and just 24% of European interns think these robots will be a positive force overall.

Morgan Stanley predicts that the humanoid market could grow massively, reaching over $5 trillion by 2050. Most of these robots—about 90%—will likely be used in industrial and commercial settings rather than in homes. They could also create large support industries for maintenance, repairs, and software updates.

**Summary**

– AI is widely used by interns and seen as helpful but needs better accuracy.

– Crypto adoption is slow among young finance professionals, even though institutional interest is rising.

– Humanoids interest is growing, but many are unsure if they’ll be good for society.

– The future looks increasingly tech-driven—with AI, crypto, and humanoid robots leading the way.

**Keywords:** AI adoption, crypto interest, Bitcoin ETFs, Ethereum price, humanoid robots, future technology trends, intern survey 2025, Morgan Stanley insights, artificial intelligence in finance, digital asset adoption

Unilabs Presale Soars as SOL and XRP Struggle

Solana and XRP are two of the biggest names in crypto, but their prices are making investors nervous. Both coins are struggling to hold steady, and that’s pushing more people to look for newer, faster-growing opportunities. One project catching a lot of attention right now is Unilabs Finance (UNIL), which is gaining serious momentum with its presale.

**Solana Price Struggles, But There’s Still Hope**

Solana (SOL) has been hovering around $180-$190 lately. It’s down about 7% over the past week, which has left many traders unsure of what’s next. However, some analysts still believe SOL could bounce back and reach between $204 and $208 by the end of 2025.

Even with this potential upside, many investors are hesitant. The slow movement and uncertain outlook are leading people to consider other options with more aggressive growth potential.

**XRP Shows Signs of Life, But Progress Is Slow**

XRP recently dropped to about $2.80 after hitting a recent high of $3.40. While some technical indicators hint at a possible rebound, XRP hasn’t shown strong momentum lately.

Because of this, many investors are shifting their focus from XRP to more exciting projects like Unilabs Finance. With its cutting-edge features and fast-growing presale, UNIL is starting to look like one of the best long-term crypto investments right now.

**Unilabs Finance: The Hottest Crypto Presale in 2024**

While Solana and XRP continue to move slowly, Unilabs Finance is turning heads. The project has already raised over $15 million during its presale, and its current token price is just $0.0108. Early buyers have seen gains of over 170%, and there’s still time to get in before the price increases to the next stage at $0.012.

To sweeten the deal, new buyers can use the coupon code “UNIL40” to get a 40% bonus on their purchase.

So why is Unilabs gaining so much attention? The platform offers a unique mix of tools that help users succeed in the fast-moving world of DeFi:

– **Memecoin Identification Tool**: Automatically finds meme coins with strong viral potential.

– **Flash Loan Accelerator**: Lets users borrow large amounts of capital to execute high-reward strategies.

– **AI Portfolio Management**: Smart tools that adjust your crypto investments based on market trends.

These features make Unilabs not just another token but a complete ecosystem designed to maximize returns in a smart and automated way.

**Which Crypto Has the Most Upside Going Into 2025?**

Let’s break down how Unilabs (UNIL), Solana (SOL), and XRP compare in terms of investment potential:

| Metric | Unilabs (UNIL) | Solana (SOL) | Ripple (XRP) |

|————————|————————|————————-|————————|

| Price | $0.0108 (next: $0.012) | $178 | $2.81 |

| 2025 Potential | Up to 100x | Forecasts up to $208 | Possible rebound to $4 |

| Recent Trend | +170% for early buyers | -9% weekly | Down from $3.40 |

| Key Features | AI tools, Flash loans | Fast network, trading | Remittances, low fees |

While SOL and XRP are still important players in the crypto space, their growth seems slower compared to newer projects like Unilabs Finance. With its powerful features and strong presale performance, UNIL is quickly becoming a top choice for investors aiming for high returns in 2025.

**Join the Unilabs Presale Today:**

– Website: https://www.unilabs.finance/

– Telegram: https://t.me/unilabsofficial/

– Twitter: https://x.com/unilabsofficial/

If you’re looking for the next big crypto project with strong growth potential, Unilabs Finance might be it.

Markets Rally on Fed Hints and AI-Crypto Optimism

**Markets React to Fed’s Jackson Hole Speech with Optimism**

Last Friday, Federal Reserve Chair Jerome Powell delivered a highly anticipated speech at the Jackson Hole Symposium, which caused a noticeable shift in market sentiment. Powell acknowledged that inflation has come down from its peak but is still not at the Fed’s 2% goal. He emphasized that the Fed is ready to adjust interest rates if inflation continues to drop, hinting at a possible rate cut in the near future. However, he made it clear that the Fed will move carefully and keep watching the data to avoid a rebound in inflation.

This cautious but optimistic tone sparked a positive reaction across financial markets. The S&P 500 jumped 1.52% on Friday, closing the week up 0.3% at 6,466 points. The U.S. dollar weakened on the rate cut hopes, boosting gold prices by 0.98%, bringing it close to $3,371. U.S. 10-year Treasury yields also fell sharply to 4.25%, reflecting increased demand for bonds.

Bitcoin (BTC) was among the big gainers for the week, surging past $117,000 as investor appetite for risk assets returned.

**Intel Deal with U.S. Government Strengthens Semiconductor Push**

In a major move for U.S. tech infrastructure, the government will take a 9.9% passive equity stake in Intel worth $8.9 billion. This investment comes through a conversion of CHIPS Act grants and Secure Enclave program funds into non-voting stock. While the government won’t have control or board seats, it secured a five-year warrant to buy an additional 5% if Intel’s ownership share in its foundry business drops below 51%.

This strategic deal is seen as part of broader efforts to boost domestic semiconductor manufacturing and reduce reliance on overseas chipmakers.

**U.S. and EU Clarify Tariff Rules in New Trade Framework**

The U.S. and European Union provided more details about their revised trade agreement, setting clear 15% tariffs on key goods like pharmaceuticals, semiconductors, lumber, and cars. While this offers clarity on previously vague rules, businesses remain cautious due to uncertainties around enforcement and long-term stability of the deal.

**Apple and Google Eye AI Collaboration for Siri Upgrade**

Apple is reportedly in early discussions with Google to use its Gemini AI model to enhance Siri’s capabilities. This potential partnership between two tech giants triggered a surge in investor confidence, pushing Alphabet’s stock up by 4% and Apple’s by 2%. The move signals Apple’s growing focus on integrating advanced AI into its ecosystem.

**Tech Investment Trends: Who’s Spending Big on Innovation?**

According to UBS Weekly Intelligence, Meta, Intel, and Oracle are currently the biggest spenders when it comes to capital expenditures (capex) and research & development (R&D), based on their sales ratios. In contrast, companies like Mastercard, Uber, and Accenture are spending far less.

Among other top names: Microsoft spends 36% of its sales on capex and R&D, Amazon 31%, Alphabet 35%, and Apple 11%. These numbers highlight which companies are putting serious money into innovation, especially amid the ongoing AI boom.

**Crypto Market Bounces Back After Fed Remarks**

Crypto markets got a boost following Powell’s Jackson Hole comments suggesting a potential rate cut soon. Bitcoin jumped back above $117K after dipping below $112K earlier in the week. Crypto-related stocks like MicroStrategy and Coinbase climbed 5–7%. Altcoins such as Ethereum (ETH) and Solana also surged — ETH rose by 15% on Friday alone, surpassing $4,800.

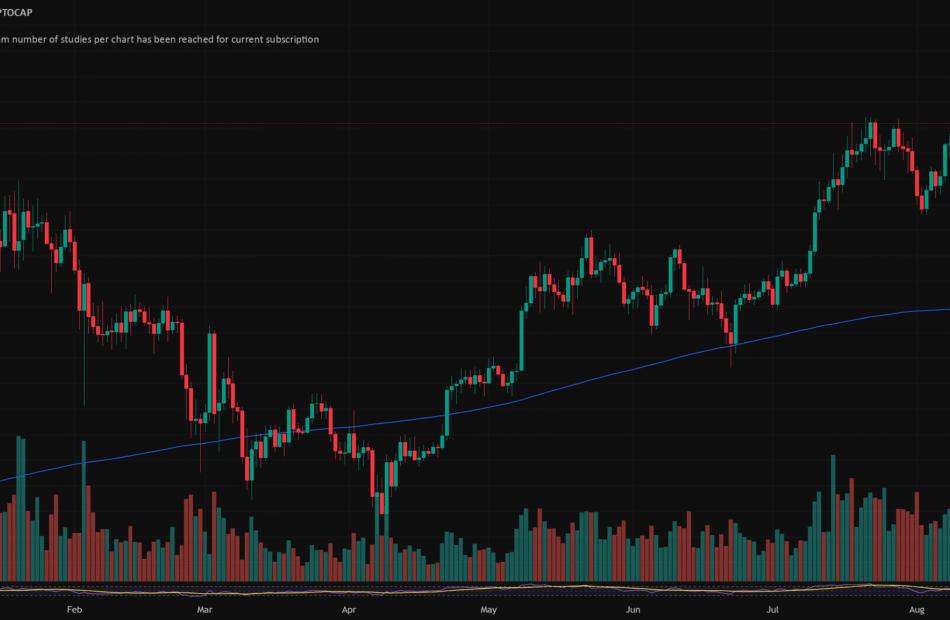

Despite Friday’s rally, the overall crypto market cap only grew modestly by $9 billion for the week. Trading volumes surged to $468 billion daily, up from $312 billion the week before. Since the start of the year, total crypto market capitalization has grown by 22%, with $702 billion in net inflows.

Ethereum stood out as a top performer last week, gaining 7% and adding over $37 billion to its market cap — reaching a new all-time high of $4,877. Meanwhile, Bitcoin ended the week down 2.13%, dropping to $115K during Saturday trading. Other altcoins showed mixed results: Chainlink (LINK) rose by 14.5%, ZCash gained 16%, and Solana increased by 7.5%. Maker was one of the few laggards, falling by 7.3%.

In terms of circulating supply changes, Polkadot saw a slight increase of 0.6%, while Filecoin’s supply dropped by 0.6% — a rare occurrence for this coin. Cardano (ADA) also increased its supply by 0.3%, and Bitcoin’s circulating coins were up slightly by 0.1%.

**Crypto Futures: ETH Bullish While BTC Lags**

In the crypto futures market, Bitcoin futures saw slight declines across all contracts. The steepest drops were in March 2026 (-2.08%) and June 2026 (-1.93%). Despite short-term softness, long-term sentiment remained stable with December 2026 BTC futures closing at $126,795.

Ethereum futures painted a more bullish picture with strong weekly gains around 10% across all maturities. The October 2025 contract rose the most at +10.3%. December 2026 ETH futures hit an all-time high of $5,347, while December 2025 closed at $4,994 — showing strong investor confidence in Ethereum’s long-term growth.

Overall, last week showcased a renewed appetite for risk among investors across both traditional markets and digital assets, driven largely by hopes of easing monetary policy and growing excitement around artificial intelligence and blockchain innovation.

Ethereum Soars 10% as Unilabs Emerges as 2025 Contender

**Ethereum Price Jumps 10% — Could Hit $5K Soon**

Ethereum (ETH) is on a major upswing. In the past 24 hours alone, its price jumped by 10.08%, reaching $4,721.43. This surge pushed its market cap to a massive $569.81 billion. Trading activity also exploded, with volume increasing by over 122% to hit $79.02 billion.

What’s driving this rally? A lot of it comes down to the growing excitement around an Ethereum ETF (Exchange-Traded Fund). Big institutional investors are pouring in, and that’s creating serious momentum. Some experts believe ETH could reach the $5,000 mark before the end of the year.

**Supply Is Drying Up — Fueling the Price Boom**

There’s another reason behind Ethereum’s price surge: a major supply squeeze. Right now, there are only 18.8 million ETH left on crypto exchanges. That’s a sign that large investors — often called “whales” — are pulling their coins off platforms and holding them long-term. When supply goes down like this and demand keeps rising, prices tend to shoot up fast.

Ethereum has also been showing strong technical signals like Break of Structure (BOS), which means it’s holding key support levels and moving higher with confidence. With ETH trading above $4,700 now, the overall trend looks bullish.

**But Not Everyone Is Sold on Ethereum for 2025**

Even though Ethereum is flying high, some investors are still cautious. The concerns mostly revolve around ETH’s high price and expensive gas fees, which can make using the network costly.

Because of that, more crypto investors are starting to look at smaller, newer projects that could offer bigger growth potential in 2025.

**Meet Unilabs (UNIL): A Rising Star in Crypto**

One of the top names popping up in these conversations is Unilabs (UNIL). It’s an AI-powered crypto mining project that uses clean energy and aims to bridge traditional finance (TradFi) with decentralized finance (DeFi).

Unilabs is still in its presale phase but already making waves globally:

– Over 2.1 billion UNIL tokens sold so far

– Current price: $0.0108 — set to increase to $0.012 soon

– Presale is already 43.18% through Phase 7

– AI-based crypto ecosystem with smart automation and scalability

– $30 million in Assets Under Management (AUM)

– Four AI-driven funds targeting Bitcoin, Real World Assets (RWAs), mining, and AI-focused baskets

Unilabs also has exciting features coming soon like a staking platform, Web3 wallet integration, and advanced payment systems. All of this is helping to position UNIL as one of the best cryptos to watch for explosive growth in 2025.

**Ethereum vs Unilabs: Which One Fits You Best?**

| Feature | Ethereum (ETH) | Unilabs (UNIL) |

|———————|—————————————-|—————————————-|

| Current Price | $4,721.43 (+10.08%) | $0.0108 (Presale Phase 7) |

| Market Cap | $569.81 Billion | Early-stage with high growth potential |

| Growth Driver | ETH ETF & institutional demand | AI-powered mining & presale momentum |

| Liquidity | Low supply: Only 18.8M ETH on exchanges | Over 2.1B tokens already sold |

| Accessibility | Available on all major exchanges | Available via ongoing presale |

| Best For | Conservative investors | Risk-takers looking for 100x gains |

If you’re after steady performance from a top-tier cryptocurrency, Ethereum still stands strong. But if you’re hunting for the next big breakout in crypto — especially in this bull cycle — Unilabs is looking like a real contender.

**Why Unilabs Could Be the Best Crypto Investment in 2025**

Ethereum’s current rally shows how powerful institutional interest can be. But for those looking to get in early on the next major mover, Unilabs offers something different: a cutting-edge AI-driven platform with real-world use cases and major investor traction.

With advanced tech, clean energy mining, and strong DeFi features, UNIL could be one of the top altcoins in 2025.

**Ready to Explore Unilabs?**

Join the presale and get involved early in one of the most promising crypto projects of the year.

**Visit Website**

**Join Telegram**

**Keywords:** Ethereum price today, ETH ETF news, Unilabs crypto presale, best altcoins 2025, AI crypto projects, clean energy mining crypto, Ethereum vs Unilabs, top new cryptocurrencies

Ethereum Surges, BTC Miner Offers Stable Crypto Income

**Ethereum Hits New Highs, Investors Seek Stable Alternatives Like BTC Miner Cloud Mining**

Ethereum (ETH) has hit a new all-time high, reaching $4,882 and closing near $4,845. This surge came after Federal Reserve Chair Jerome Powell gave hints that interest rate cuts might be on the horizon. The news boosted investor confidence, helping ETH gain around 45% so far this year—much more than Bitcoin’s 25% rise.

This rise in Ethereum’s price has sparked major interest from big institutions. They’re investing heavily in Ethereum because of its powerful blockchain, which supports smart contracts and digital tokenization. But with high returns comes high volatility, making some investors nervous about sudden price swings.

That’s why many are turning to BTC Miner Cloud Mining — a smarter and more stable way to earn passive crypto income without riding the ups and downs of the market.

**What Is BTC Miner Cloud Mining?**

BTC Miner is a user-friendly, AI-powered cloud mining platform. It helps you earn daily crypto profits without needing to buy mining equipment or pay high electricity bills. Everything is handled for you — it’s automatic, safe, and easy to use.

You don’t have to be a tech expert. BTC Miner is built for everyday users who want a simple and reliable way to earn crypto income passively.

**Why Choose BTC Miner Cloud Mining?**

– **Free $500 Trial Credit** – Start mining with zero upfront payment.

– **Fixed Daily Profits (Up to 6.61%)** – Earn guaranteed returns every day using smart contracts.

– **Mine Multiple Coins** – Includes BTC, ETH, XRP, SOL, DOGE, USDT, BNB, and others.

– **Flexible Plans** – Choose short-term or long-term mining contracts to fit your goals.

– **Live Dashboard** – Track your earnings in real-time and withdraw anytime.

– **Referral Bonuses** – Earn extra: 7% from direct referrals and 2% from their referrals.

– **Top-Level Security** – Your funds are protected with encryption, insurance, and secure custody.

**Example of BTC Miner Contracts**

You can pick a contract based on how much you want to invest:

– $200 for 2 days → $10 daily → Total $20

– $300 for 3 days → $4.95 daily → Total $14.85

– $1,000 for 7 days → $20.10 daily → Total $140.70

– $2,500 for 10 days → $62.75 daily → Total $620.75

– $5,000 for 15 days → $137.50 daily → Total $2,062.50

– $10,000 for 20 days → $300 daily → Total $6,000

– $30,000 for 30 days → $1,086 daily → Total $32,580

These contracts allow users to generate predictable crypto income without stress or speculation.

**How to Get Started with BTC Miner**

Getting started is simple:

1. Sign up on the platform.

2. Try the free trial credit.

3. Choose a mining contract that fits your budget and timeframe.

4. Watch your earnings grow daily.

No hardware needed. No technical skills required.

**Why Now Is the Right Time**

Ethereum’s rapid price growth shows how fast the crypto market can move — both up and down. While ETH is hot right now, its price can still swing wildly. That’s where BTC Miner becomes valuable. It gives you steady returns no matter what the market is doing.

Whether ETH keeps climbing or takes a dip, BTC Miner provides a stable way to earn from crypto without needing to constantly watch prices.

**About BTC Miner Cloud Mining**

BTC Miner is a next-generation cloud mining platform that uses AI automation and secure smart contracts to deliver consistent passive income in crypto. With no need for hardware or complex setups, it opens the door for anyone—anywhere—to start earning crypto safely and easily.

If you’re looking for a low-effort way to grow your crypto earnings while avoiding risky trading moves, BTC Miner Cloud Mining could be the perfect solution.