RWA Tokenization: Real Assets Meet Blockchain Finance

**Real-World Asset Tokenization: The Future of Finance on Blockchain**

After Bitcoin, decentralized finance (DeFi) was the next big thing in blockchain. It aimed to recreate the entire financial system without banks or middlemen. From less than $1 billion in early 2020, DeFi’s total value locked (TVL) exploded to $174 billion by late 2021. But after the collapse of FTX and other crypto firms between 2022 and 2025, interest in DeFi cooled down.

At the same time, another trend quietly gained momentum — Real-World Asset (RWA) tokenization. This idea started small with around $200 million in TVL in late 2022. By January 2026, it had grown massively to $19.4 billion. So what exactly is RWA tokenization, and why is it growing when other crypto ideas faded?

—

**What Is RWA Tokenization?**

RWA tokenization means turning real-world assets like government bonds, real estate, and commodities into digital tokens on a blockchain. These aren’t imaginary internet assets like NFTs or virtual land. They’re tied to actual financial instruments that already have value in the traditional economy.

Examples include:

– U.S. Treasury bonds

– Real estate properties

– Commodities like gold

– Private and corporate credit instruments

These tokenized assets are managed using smart contracts and other blockchain tools, but their value comes from things that exist outside the blockchain — not just hype or memes.

—

**Why Did Metaverse and NFTs Fail While RWAs Grew?**

In 2022, big companies like J.P. Morgan predicted huge profits from the metaverse — up to $1 trillion per year. But reality didn’t live up to the hype. Projects like Decentraland (MANA) and Sandbox (SAND) dropped more than 70% in value year-over-year. Even ApeCoin (APE), linked to the biggest NFT brand, crashed over 80%.

The metaverse was built on excitement around NFTs, which were supposed to represent ownership of digital land, avatars, and virtual items. People thought these would be valuable because they’d be scarce. But when crypto markets crashed and free AI art tools became widely available, the demand for NFTs dried up fast.

In short, the metaverse and NFT markets relied on hype and community belief. When that disappeared, so did their value.

—

**Why RWA Tokenization Is Different**

Unlike metaverse tokens that tried to copy real-world assets, RWAs connect actual real-world financial products directly to blockchain systems. This makes them more stable and useful.

Here’s why RWAs make sense:

– Governments and corporations already issue bonds to raise money.

– Real estate is a key part of every economy.

– Commodities like gold have lasting value.

RWAs bring these existing assets onto the blockchain using secure smart contracts and regulatory controls. Instead of depending on public excitement, they rely on real financial demand.

—

**How RWA Tokenization Improves Finance**

The traditional financial system has a lot of moving parts — stock exchanges, banks, custodians, clearinghouses — that slow down processes and create risks. For example:

– Stock trades can take two days to settle (T+2).

– Capital is locked up during settlement windows.

– Dividend payments are delayed or manual.

Tokenizing RWAs changes all this by putting everything on a single blockchain layer:

1. **Instant Settlement**: Trades can settle in seconds instead of days. Smart contracts instantly connect money to asset ownership.

2. **More Liquidity**: Banks and funds no longer need to keep cash reserves for failed settlements. This frees up capital for other uses.

3. **Programmable Payments**: Smart contracts can make automatic payments — for example, interest on a bond paid every second instead of every six months.

These benefits make financial operations faster, cheaper, and more efficient — not just for retail investors but especially for large institutions.

—

**Who Uses RWA Tokenization Today?**

As of January 2026, the RWA market is worth $19.38 billion. The biggest chunk comes from tokenized U.S. Treasury bonds ($8.76 billion), followed by:

– Commodities: $3.6 billion

– Institutional funds: $2.4 billion

– Private credit: $2.3 billion

Other categories like stocks, corporate bonds, and non-U.S. government debt are still small but growing.

Due to regulations and privacy needs, most of this happens on permissioned blockchains — private networks that only verified institutions can join.

One major example is **Canton Network**, supported by big names like Microsoft, Deloitte, Circle, Paxos, and S&P Global. Canton controls about 95% of the RWA market. It uses Daml smart contracts with built-in compliance checks.

Another player is **Provenance Blockchain**, which runs on Cosmos technology and holds about 3.72% of the market. It’s more open than Canton but still geared toward institutions.

—

**Can Regular People Access RWAs?**

Right now, most RWA platforms are limited to accredited investors due to compliance rules like KYC (Know Your Customer) and KYB (Know Your Business). However, some efforts are being made to bridge the gap:

– **Maple Finance** offers a DeFi protocol called Syrup (SYRUP) to let more people access institutional yield opportunities.

– **MakerDAO** uses tokenized U.S. Treasuries as collateral for its DAI stablecoin.

– **Aave** launched Horizon Market for accredited investors with access to VanEck Treasury Funds via Securitize.

– **Paxos Gold (PAXG)** and **Tether Gold (XAUT)** let anyone buy tokenized gold easily.

So while most RWAs are still locked behind institutional walls, a few options are starting to reach everyday users.

—

**The Bottom Line**

Real-World Asset tokenization isn’t about reviving retail crypto dreams or hyped-up digital land sales. It’s a slow but steady shift of real finance onto blockchain rails. Instead of relying on memes or social media buzz, RWAs connect blockchains to proven assets like government debt, real estate, and commodities.

The key challenge now is regulation. The tech is already there — instant settlement, automated payments, increased liquidity — but broader retail access depends on global legal frameworks catching up.

In the meantime, RWA tokenization continues growing behind the scenes, not as a trend but as a fundamental upgrade to how finance works.

RWA Tokenization: Real Assets Meet Blockchain Finance

**Real-World Asset Tokenization: The Future of Finance on Blockchain**

After Bitcoin, decentralized finance (DeFi) was the next big thing in blockchain. It aimed to recreate the entire financial system without banks or middlemen. From less than $1 billion in early 2020, DeFi’s total value locked (TVL) exploded to $174 billion by late 2021. But after the collapse of FTX and other crypto firms between 2022 and 2025, interest in DeFi cooled down.

At the same time, another trend quietly gained momentum — Real-World Asset (RWA) tokenization. This idea started small with around $200 million in TVL in late 2022. By January 2026, it had grown massively to $19.4 billion. So what exactly is RWA tokenization, and why is it growing when other crypto ideas faded?

—

**What Is RWA Tokenization?**

RWA tokenization means turning real-world assets like government bonds, real estate, and commodities into digital tokens on a blockchain. These aren’t imaginary internet assets like NFTs or virtual land. They’re tied to actual financial instruments that already have value in the traditional economy.

Examples include:

– U.S. Treasury bonds

– Real estate properties

– Commodities like gold

– Private and corporate credit instruments

These tokenized assets are managed using smart contracts and other blockchain tools, but their value comes from things that exist outside the blockchain — not just hype or memes.

—

**Why Did Metaverse and NFTs Fail While RWAs Grew?**

In 2022, big companies like J.P. Morgan predicted huge profits from the metaverse — up to $1 trillion per year. But reality didn’t live up to the hype. Projects like Decentraland (MANA) and Sandbox (SAND) dropped more than 70% in value year-over-year. Even ApeCoin (APE), linked to the biggest NFT brand, crashed over 80%.

The metaverse was built on excitement around NFTs, which were supposed to represent ownership of digital land, avatars, and virtual items. People thought these would be valuable because they’d be scarce. But when crypto markets crashed and free AI art tools became widely available, the demand for NFTs dried up fast.

In short, the metaverse and NFT markets relied on hype and community belief. When that disappeared, so did their value.

—

**Why RWA Tokenization Is Different**

Unlike metaverse tokens that tried to copy real-world assets, RWAs connect actual real-world financial products directly to blockchain systems. This makes them more stable and useful.

Here’s why RWAs make sense:

– Governments and corporations already issue bonds to raise money.

– Real estate is a key part of every economy.

– Commodities like gold have lasting value.

RWAs bring these existing assets onto the blockchain using secure smart contracts and regulatory controls. Instead of depending on public excitement, they rely on real financial demand.

—

**How RWA Tokenization Improves Finance**

The traditional financial system has a lot of moving parts — stock exchanges, banks, custodians, clearinghouses — that slow down processes and create risks. For example:

– Stock trades can take two days to settle (T+2).

– Capital is locked up during settlement windows.

– Dividend payments are delayed or manual.

Tokenizing RWAs changes all this by putting everything on a single blockchain layer:

1. **Instant Settlement**: Trades can settle in seconds instead of days. Smart contracts instantly connect money to asset ownership.

2. **More Liquidity**: Banks and funds no longer need to keep cash reserves for failed settlements. This frees up capital for other uses.

3. **Programmable Payments**: Smart contracts can make automatic payments — for example, interest on a bond paid every second instead of every six months.

These benefits make financial operations faster, cheaper, and more efficient — not just for retail investors but especially for large institutions.

—

**Who Uses RWA Tokenization Today?**

As of January 2026, the RWA market is worth $19.38 billion. The biggest chunk comes from tokenized U.S. Treasury bonds ($8.76 billion), followed by:

– Commodities: $3.6 billion

– Institutional funds: $2.4 billion

– Private credit: $2.3 billion

Other categories like stocks, corporate bonds, and non-U.S. government debt are still small but growing.

Due to regulations and privacy needs, most of this happens on permissioned blockchains — private networks that only verified institutions can join.

One major example is **Canton Network**, supported by big names like Microsoft, Deloitte, Circle, Paxos, and S&P Global. Canton controls about 95% of the RWA market. It uses Daml smart contracts with built-in compliance checks.

Another player is **Provenance Blockchain**, which runs on Cosmos technology and holds about 3.72% of the market. It’s more open than Canton but still geared toward institutions.

—

**Can Regular People Access RWAs?**

Right now, most RWA platforms are limited to accredited investors due to compliance rules like KYC (Know Your Customer) and KYB (Know Your Business). However, some efforts are being made to bridge the gap:

– **Maple Finance** offers a DeFi protocol called Syrup (SYRUP) to let more people access institutional yield opportunities.

– **MakerDAO** uses tokenized U.S. Treasuries as collateral for its DAI stablecoin.

– **Aave** launched Horizon Market for accredited investors with access to VanEck Treasury Funds via Securitize.

– **Paxos Gold (PAXG)** and **Tether Gold (XAUT)** let anyone buy tokenized gold easily.

So while most RWAs are still locked behind institutional walls, a few options are starting to reach everyday users.

—

**The Bottom Line**

Real-World Asset tokenization isn’t about reviving retail crypto dreams or hyped-up digital land sales. It’s a slow but steady shift of real finance onto blockchain rails. Instead of relying on memes or social media buzz, RWAs connect blockchains to proven assets like government debt, real estate, and commodities.

The key challenge now is regulation. The tech is already there — instant settlement, automated payments, increased liquidity — but broader retail access depends on global legal frameworks catching up.

In the meantime, RWA tokenization continues growing behind the scenes, not as a trend but as a fundamental upgrade to how finance works.

Travis Ford Busted in $10M Crypto Ponzi Scheme

Travis Ford and his company, Wolf Capital Crypto Trading, are facing serious legal trouble for running a fake crypto investment scheme. According to the Commodity Futures Trading Commission (CFTC), Ford tricked thousands of people into putting money into what turned out to be a scam.

Between October 2022 and December 2024, Ford raised over $10.1 million from more than 3,300 investors. He promised them huge daily returns—between 1% and 3.5%—claiming he could earn those profits by trading Bitcoin, Ethereum, and crypto futures using a mix of manual strategies and trading bots. That would’ve meant yearly gains as high as 1,277%, which is far beyond what’s realistic in any market.

Ford marketed himself as a successful trader, even saying he made a fortune trading oil during the COVID-19 pandemic. But regulators say that wasn’t true. In reality, he had little experience with digital assets and lost money trading oil-related stocks.

The CFTC says Ford misled investors by only showing them winning trades on Telegram and Discord while hiding his losses. For example, from February to July 2023, he claimed he made $3.5 million in profits. But records from a crypto exchange showed that he actually lost around $869,000 during that time. That’s a difference of over $4.3 million.

Ford later admitted to faking screenshots of trades and portfolio values using Photoshop to make it look like people were making money when they weren’t. By August 2023, Wolf Capital only had about $3,000 left—far less than what investors were told.

As the losses piled up and he couldn’t pay the promised returns, Ford started using new investors’ money to pay earlier ones—classic Ponzi scheme behavior. In total, he paid out about $2.4 million in fake “returns” using funds from other investors.

He even tried to keep the scheme alive by lowering daily returns from 2% to 1.5% in April 2023 and then again to 1.1% in June. But by July 2023, he shut everything down.

Investors were told they could withdraw their money after a 60-day lockup period, but most never got their original deposits back. Ford kept encouraging them to leave their funds in the smart contract system, promising future profits that never came.

Neither Ford nor Wolf Capital was registered with the CFTC as required by law for commodity pool operators. The CFTC has been cracking down on similar crypto and forex scams, including one involving $145 million in fraud.

In criminal court, Ford pleaded guilty to conspiracy to commit wire fraud on January 9, 2025. He admitted that he knew the returns he promised were impossible and that he lied to get people to invest or stay invested in his project. He was sentenced to five years in prison and ordered to pay financial penalties on November 13, 2024.

The CFTC’s civil complaint is seeking to recover money for victims, force Ford to give up his illegal profits, fine him further, and permanently ban him and his company from participating in any trading or investment activities under CFTC oversight.

This case is similar to other recent crypto scams where fraudsters used flashy tech promises or AI claims to lure investors into fake trading platforms. Wolf Capital was initially just Ford’s personal business but was later registered as an LLC in Oklahoma in April 2023 before being marked as inactive.

Keywords: Travis Ford crypto scam, Wolf Capital fraud, CFTC crypto complaint, cryptocurrency investment fraud, Ponzi scheme blockchain, fake crypto trading profits, Ethereum smart contract fraud, unregistered commodity pool operator, crypto trading bot scam

Ethereum Set for Major Growth by 2026, Analysts Say

Ethereum is once again grabbing the spotlight in the crypto world. Whether it’s the growing trend of tokenizing real-world assets or major developments across its ecosystem, ETH continues to attract serious attention. Even with market conditions being uncertain, Ethereum is gaining more interest and may be gearing up for a big breakout in 2026. With prices currently dipping, some investors are starting to ask: Is now a good time to buy?

One major reason Ethereum is making headlines is its growing role in tokenization — the process of moving real-world assets like real estate, bonds, or stocks onto the blockchain. As this movement gains traction, Ethereum is emerging as the top choice to host these digital assets. Analysts believe this strong position could make ETH one of the most valuable crypto assets by 2026.

A recent analysis from CryptosRUs highlights how Ethereum is performing exceptionally well, even in a bearish market. Normally, when the crypto market slows down, so does network activity. But Ethereum is defying that trend:

– Daily active wallet addresses have hit an all-time high (ATH)

– The number of daily transactions is at an ATH

– Stablecoin supply on Ethereum is almost at an ATH

– More ETH than ever before is being staked

– Gas fees are back to levels seen in mid-2020

These are strong signals that Ethereum is still growing, scaling, and seeing increased usage — even when prices are low. This shows that investors and users still believe in ETH’s long-term value.

Another reason ETH is gaining momentum is growing interest from large institutions. Despite ETH being down 35% from its all-time high, big players aren’t backing off — they’re doubling down. For example:

– BitMine and other treasury companies are buying and holding ETH

– Ethereum ETFs recently saw their biggest weekly inflow since last October’s market crash

– JPMorgan launched its first tokenized money-market fund using the Ethereum blockchain

These developments suggest that major financial institutions see strong potential in Ethereum and are starting to invest more heavily.

A key event that could drive Ethereum’s growth even further is the expected approval of the Clarity Act — a proposed law that would provide clearer regulations for crypto assets beyond Bitcoin. While Bitcoin already enjoys regulatory clarity, most altcoins like Ethereum do not. If this act passes, it could boost trust and adoption for projects built on Ethereum, especially in areas like DeFi (decentralized finance), AI integration, and stablecoins.

According to crypto analysts, Ethereum leads in all these areas, and more regulation could bring more users and developers to its ecosystem — increasing network activity and driving up demand for ETH.

Lastly, there’s a macroeconomic factor at play: U.S. Federal Reserve interest rates. Experts predict that by 2026, interest rates will drop again. This would make traditional investments like T-bills less attractive due to lower returns. In contrast, ETH offers a 2.5%–3% yield through staking, plus the potential for price growth. As a result, institutional investors could shift more capital into Ethereum.

In short, despite current market dips, Ethereum is showing strong signs of long-term strength. With rising network activity, increased institutional interest, potential regulatory clarity, and favorable economic conditions ahead, many believe ETH could be one of the best-performing assets by 2026.

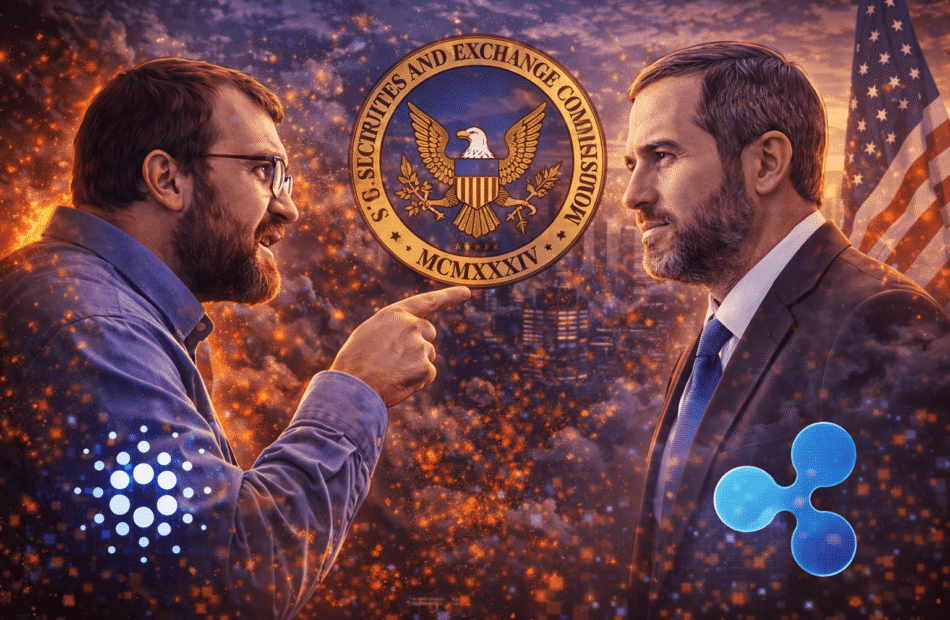

Hoskinson Slams CLARITY Act, Calls Out Ripple CEO

Cardano founder Charles Hoskinson is once again making headlines, this time for speaking out strongly against the proposed Digital Asset Market CLARITY Act of 2025. In a recent livestream, he not only criticized the bill but also took aim at Ripple CEO Brad Garlinghouse for supporting it. Hoskinson accused Garlinghouse of giving in to regulators who have previously targeted crypto companies like Ripple.

The CLARITY Act is a proposed U.S. law that aims to create clear rules for the crypto industry. It covers a wide range of topics, including how to classify digital tokens, regulate DeFi platforms, manage stablecoins, and decide which government agencies will oversee different parts of the market. While many in the crypto space originally supported the bill, some major players are now backing away.

Hoskinson was once a supporter of the bill himself, even participating in discussions about its development. But now, he says the bill gives too much power to the Securities and Exchange Commission (SEC), which has been known for aggressively targeting crypto projects. He believes that instead of fixing the problem, the bill could make it worse by labeling most cryptocurrencies as securities.

During his livestream, Hoskinson didn’t hold back. He slammed Garlinghouse for saying that an imperfect bill is better than no clarity at all. Hoskinson argued that giving more control to the same regulators who have sued and penalized crypto companies is a step backward. He called it a betrayal of what crypto stands for.

“Sorry Brad, it’s not better than chaos,” Hoskinson said. “Take the chaos and fight for what’s right. Fight for integrity. I didn’t sign up to hand the revolution to 15 banks.”

He also accused some crypto leaders of selling out for personal gain—chasing money, private jets, and luxury lifestyles instead of standing up for the core values of decentralization and financial freedom.

Hoskinson emphasized that he didn’t get involved in crypto to help big banks or government regulators take over. He said the original mission, inspired by Bitcoin’s creator Satoshi Nakamoto, was about giving power back to the people—not letting it be controlled by a few institutions.

While Garlinghouse was his main target, Hoskinson’s message applies to others still backing the bill as well. Kraken CEO Arjun Sethi voiced support for the CLARITY Act on the same day that Coinbase CEO Brian Armstrong announced he was withdrawing his support, citing concerns about anti-crypto measures in the bill—like a potential ban on tokenized equities.

Other influential figures such as venture capitalist Chris Dixon and White House advisor David Sacks have also expressed support for the bill, arguing that it brings needed regulatory clarity and could help U.S. companies compete globally.

In contrast, Hoskinson believes that accepting flawed regulations just for clarity is dangerous. He insists that crypto leaders should continue to push back against unfair rules and defend the original vision of decentralization and user empowerment.

Keywords: Charles Hoskinson, Brad Garlinghouse, Cardano, Ripple, CLARITY Act 2025, crypto regulation, SEC, DeFi, stablecoins, digital tokens, Coinbase, Kraken, decentralization, financial freedom, crypto industry news