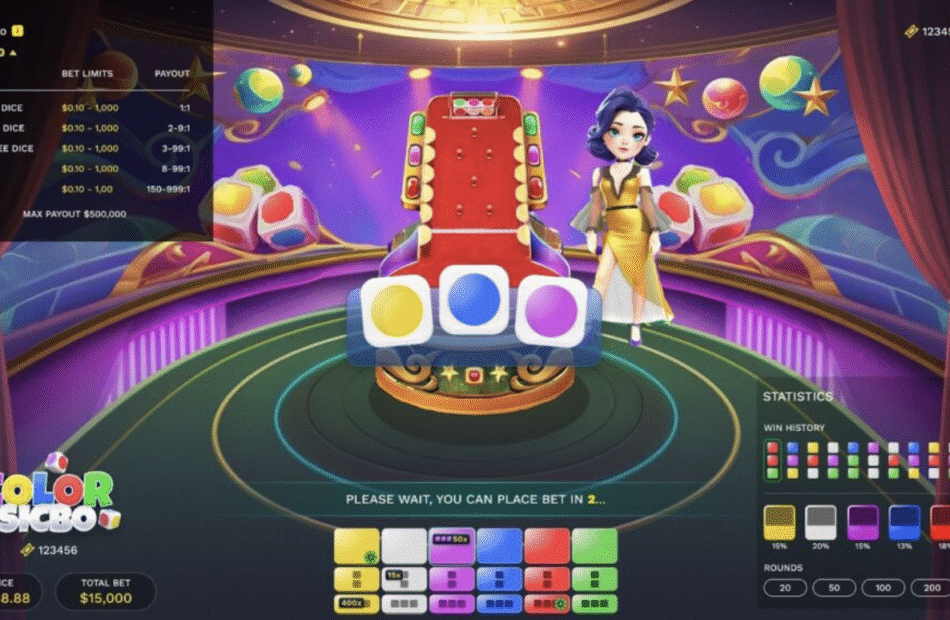

Color Sic Bo – Classic Dice Thrills in a Burst of Color By Gameplay Interactive (GPI)

Color Sic Bo is a vibrant twist on classic Sic Bo. Enjoy the same three-dice excitement with a fresh, colorful betting layout made for quick, easy rounds.

How the Game Plays

The rules are simple and instantly recognizable.

> Each round begins when players place their bets on the table.

>Then the dealer shakes three dice, and the result is revealed.

>Your win depends on how your chosen bet matches the final dice outcome — whether you’re backing single color, special combinations like doubles and triples.

Color Sic Bo adds a visual punch by mapping popular outcomes into clear color zones, making it faster to read, quicker to bet, and more exciting to follow. Even new players can jump in immediately, while experienced Sic Bo fans will love the sharper pace.

Why It’s So Fun

Color Sic Bo delivers quick dice excitement — bet, roll, reveal, and celebrate! The colorful layout makes every choice easy and intuitive, while the fast rounds keep the action flowing with no pauses. It’s simple, fun, and full of luck-driven thrills from one roll to the next.

Expect a clean interface and fun play that keeps your eyes on what matters: the next roll.

Available Now

Color Sic Bo is available across Gameplay Interactive network of partnered operators, delivering smooth, responsive gameplay and a bold new look for one of the world’s most-loved dice games.

About Gameplay Interactive (GPI)

Gameplay Interactive Games creates innovative iGaming titles that blend strong classic foundations with modern presentation and player-first design. Every release is crafted to be easy to enjoy, visually memorable, and built for nonstop entertainment.

For more information or partnership opportunities, visit gameplayint.com.

Carnival Shooter by Crescendo Games – Step Into the Fun!

Step right up and take your shot—Carnival Shooter is here to turn every spin into a spectacle! Created by Crescendo Games, this vibrant 3×5 slot bursts with playful energy, featuring wooden toys (kangaroos, lions,rabbits) , stuffed toys (teddy bears,lion and penguin), player child and a charismatic ringmaster leading the charge. With 30 dynamic paylines, cascading wins,bonus, scatters and a colorful carnival backdrop, it’s a reel ride through the midway. What sets Carnival Shooter apart is how it keeps the gameplay fresh and engaging. Whether you call it a cascade or a tumble, watching winning symbols disappear and new ones drop in adds a satisfying rhythm to every spin. It’s a mechanic that rewards momentum and keeps players on their toes. 🎯 Feature Highlights- Cascading Wins: Every win clears the way for new symbols to fall, keeping the action alive.

- Wild Symbols: Boost your chances with wilds on reels 2, 3, and 4.

- Free Spins Mode: A visual and gameplay shift—new symbols, new payouts, and extra spin potential.

- Bonus Feature: Land 3 or more BONUS symbols to trigger Free Spins, with a chance to unlock Additional Free Spins mid-round.

- Scatter Wins: Multiplied by total bet, adding a layer of excitement to every spin.

- RTP: 96.89%: Generous returns meet dynamic mechanics for a rewarding experience.

- Set your bet amount and hit the big red Spin button.

- Wins are awarded for matching symbols on active paylines—from leftmost reel to right.

- Wilds appear on reels 2–4, substituting for all symbols except BONUS.

- Winning symbols disappear, triggering cascading drops for extra chances.

- Land 3 or more BONUS symbols to unlock 6 Free Spins, with a chance to win up to 4 extra spins mid-round.

- During Free Spins, the reels transform—new animal-themed symbols, fresh paytable.

- During Free Spins, 3 or more BONUS symbols can trigger a random number of additional spins.

- Scatter wins are multiplied by your total bet

Game Details

| Feature | Info |

| Reels | 3×5 reels |

| No of Fixed Lines | 30 Lines |

| RTP | 96.89% |

| Bet | Based on your selected currency |

| Bonus | Yes, Trigger Free Spins |

How to Store Your Cryptocurrency Securely in 2025

As digital assets continue to grow in popularity, so do the risks that come with holding them. In 2025, security remains the single most important consideration for anyone managing Bitcoin, Ethereum, or other cryptocurrencies. Unlike traditional banks, where deposits are insured and customer support can reverse mistakes, crypto ownership places the responsibility squarely on you. The good news? With the right strategies and tools, you can store your cryptocurrency safely and confidently.

1. Understand the Golden Rule: Not Your Keys, Not Your Coins

The foundation of crypto security is ownership of your private keys—the cryptographic codes that control your assets. If you keep your funds on an exchange or third-party wallet, you don’t actually control those keys. Should the service be hacked or shut down, your assets may be at risk. Storing your own keys ensures true ownership and long-term safety.

2. Choose the Right Wallet Type

There are several types of wallets available in 2025, each with its strengths and trade-offs:

- Hardware Wallets (Most Secure for Long-Term Storage):

Devices like Ledger, Trezor, and SafePal remain the gold standard for securing crypto offline. They store your keys in a tamper-proof device disconnected from the internet, making it nearly impossible for hackers to reach. - Mobile and Desktop Wallets (Convenient for Everyday Use):

Apps such as Trust Wallet or Electrum give you quick access to crypto for trading or spending. While more convenient, they’re more vulnerable if your phone or computer is compromised. - Multi-Signature Wallets (Extra Layer of Protection):

These require multiple private keys to approve a transaction. Perfect for businesses or individuals who want extra protection against theft or mistakes. - Custodial Wallets (Exchange or Third-Party):

Services like Coinbase or Binance manage keys for you. They’re easy to use but rely on the security of the provider. Ideal only for short-term storage or small balances.

3. Best Practices for Securing Your Wallet

Back Up Your Recovery Phrase

When you set up a wallet, you’ll receive a 12 or 24-word seed phrase. This phrase is the master key to your funds. Write it down on paper or, even better, engrave it onto a metal backup to protect against fire, water, or physical damage. Never store it in cloud services, email, or unencrypted files.

Use Two-Factor Authentication (2FA)

If you use an exchange or hot wallet, always enable 2FA with an authenticator app (not SMS, which is vulnerable to SIM swaps).

Keep Software Updated

Wallets, exchanges, and even hardware wallets release regular updates to patch vulnerabilities. Ensure you keep all apps and devices updated.

Separate Hot and Cold Storage

Think of crypto storage like cash: keep a small “hot wallet” for daily use, and the majority in “cold storage” (offline wallets) for long-term holding.

4. Advanced Security Measures in 2025

- Biometric Authentication: Many wallets now support fingerprint or facial recognition as an added layer of security.

- Decentralized Custody Solutions: Institutional-grade services are offering secure vaults with insurance-backed protection.

- Shamir Backup Schemes: Split your seed phrase into multiple parts, each stored separately, to minimize theft or loss risk.

- Quantum-Resistant Wallets: With quantum computing on the horizon, new wallet protocols are emerging to prepare for future threats.

5. Common Mistakes to Avoid

- Storing Keys Online: Don’t keep private keys or recovery phrases in Google Drive, Dropbox, or email.

- Falling for Phishing Scams: Always double-check URLs and app publishers. Scammers frequently create fake wallet websites and support accounts.

- Reusing Wallet Addresses: For better privacy and security, avoid using the same receive address repeatedly.

- Neglecting Inheritance Planning: Without a clear plan, your crypto could be lost forever if something happens to you. Consider leaving secure instructions for trusted family members.

Conclusion

In 2025, the principles of cryptocurrency security remain the same: take responsibility for your keys, use the right tools, and stay vigilant against scams and attacks. By combining hardware wallets, safe backup practices, and modern security features like multi-signature protection, you can safeguard your digital wealth for the long term.

Final takeaway: Treat your crypto like digital gold. Secure it offline, protect your keys, and you’ll enjoy the benefits of financial sovereignty without the fear of losing it all.

How to Buy Bitcoin Safely: A Beginner’s Step-by-Step Guide

Buying Bitcoin is straightforward—but buying it safely takes a few deliberate steps. This guide walks you through the entire process, from choosing a wallet and exchange to making your first purchase and securing your coins. It’s written for beginners and focuses on practical, low-risk habits you can use right away.

Quick note: This is educational content, not financial or tax advice. Always do your own research.

Step 1: Understand the Basics (and the Risks)

- Volatility: Bitcoin’s price can move sharply. Only invest what you can afford to hold long-term.

- Irreversible transactions: If you send coins to the wrong address, there’s no chargeback.

- Self-custody responsibility: If you hold your own keys, you are the bank. That’s powerful—but you must safeguard your recovery phrase.

Step 2: Decide Where You’ll Buy

Common options:

- Regulated exchanges/brokers (recommended for beginners): Simple onboarding, bank or card deposits, clear pricing.

- P2P marketplaces: Buy from other users; more private but requires extra caution.

- Bitcoin ATMs: Convenient, but fees are typically higher.

What to look for in an exchange:

- Reputation & compliance: Established brand, clear company details, and strong track record.

- Security practices: Cold storage, insurance disclosures, and robust 2FA (preferably authenticator apps).

- Transparent fees: Published trading, deposit, and withdrawal fees.

- Liquidity: Tighter spreads (difference between buy/sell prices) reduce your cost.

- Withdrawal reliability: Easy, timely withdrawals to your own wallet.

Step 3: Set Up Your Security First (Before You Buy)

- Use a dedicated email (not used elsewhere) with a strong, unique password.

- Enable a password manager to generate/store long, unique passwords.

- Turn on 2FA using an authenticator app (avoid SMS if possible).

- Harden your device: Update your OS, browser, and antivirus; remove unknown extensions.

- Bookmark official URLs to avoid phishing; consider setting an anti-phishing code if your exchange offers it.

Step 4: Choose and Prepare Your Wallet

You can keep coins on the exchange (custodial) or move them to your own wallet (non-custodial). For maximum safety, set up your wallet before buying so you can withdraw immediately.

Wallet types:

- Hardware wallet (best for long-term): Small USB-like device that stores keys offline.

- Mobile/desktop software wallet: Good for smaller amounts and frequent spending.

- Custodial wallet (exchange): Easiest but you rely on the company’s security.

Setup steps (non-custodial):

- Generate a new wallet and write down the recovery seed phrase (12/24 words) offline on paper or a metal backup.

- Never type the phrase into websites, cloud notes, or screenshots.

- Create a strong wallet password/PIN; enable biometric unlock if available.

- (Optional) Test recovery with a small amount: wipe the wallet and restore using the seed to confirm it works.

Step 5: Create and Verify Your Exchange Account

- Sign up on your chosen exchange with your dedicated email.

- Complete KYC (ID verification) if required.

- Enable 2FA (authenticator app) immediately.

- Set withdrawal protection (address allowlisting, device approvals, withdrawal delays) if available.

- Add payment method: Bank transfer is typically cheaper; cards are faster but can cost more.

Step 6: Make Your First Purchase (The Low-Risk Way)

- Start small: Do a tiny test buy to get comfortable with the interface and fees.

- Order type:

- Market order buys instantly at current price (simple, but can include slippage).

- Limit order lets you set your price (more control, may take longer).

- Market order buys instantly at current price (simple, but can include slippage).

- Confirm you’re buying real BTC on the Bitcoin network (not a wrapped token or a different network).

- Dollar-Cost Averaging (DCA): Consider small, regular buys to reduce timing risk.

Step 7: Withdraw to Your Own Wallet (Recommended)

Exchanges are convenient but not risk-free. Withdrawing to your wallet gives you full control.

- Copy your wallet’s Bitcoin receive address (starts with “bc1…” for bech32).

- Triple-check the address before pasting—beware of clipboard-hijacking malware.

- Send a test withdrawal (e.g., a small amount) before moving larger sums.

- Choose an appropriate fee: Higher fee = faster confirmation; many exchanges set this automatically.

- Track the transaction on a block explorer until confirmed.

Step 8: Lock Down Your Long-Term Security

- Protect your recovery phrase: Store offline in two secure places (e.g., separate locations).

- Update firmware (hardware wallets) and app versions regularly.

- Use coin control/privacy basics (advanced): avoid address reuse and be mindful of how you combine UTXOs.

- Beware of social engineering: No support agent will ever ask for your seed phrase.

- Plan inheritance: Leave clear, secure instructions for trusted beneficiaries.

Step 9: Keep Records for Taxes & Compliance

- Save receipts and transaction IDs.

- Export trade history from your exchange periodically.

- Track cost basis (what you paid) and holding periods; consult a tax professional for your jurisdiction.

Common Scams to Avoid

- Guaranteed returns / “account managers”: No legitimate service guarantees profits.

- Phishing sites & fake apps: Always verify URLs and official app publishers.

- Giveaways & airdrops requiring your seed phrase: A real service will never ask for it.

- Address poisoning/dusting: Always verify addresses carefully; don’t rely on “recent” address lists.

- Imposter support: Scammers posing as exchange or wallet support on social media.

Fees 101 (So You Don’t Overpay)

- Trading fees: Charged by the exchange (maker/taker).

- Deposit/withdrawal fees: Bank wires, cards, crypto withdrawal fees.

- Network fees: Paid to Bitcoin miners; varies with network congestion.

Tips to lower costs:

- Prefer bank transfers over cards when possible.

- Use limit orders (often lower “maker” fees).

- Batch withdrawals instead of many small ones (when safe to do so).

Quick Checklist (Print or Save)

- Dedicated email + strong password + authenticator 2FA

- Reputable exchange with clear fees and smooth withdrawals

- Non-custodial wallet set up; seed phrase backed up offline

- Small test buy and small test withdrawal first

- Verify network (BTC) and addresses every time

- Records exported for tax tracking

- Ongoing security hygiene and scam awareness

Buying Bitcoin safely is less about technical skill and more about disciplined habits: control your keys, verify everything, and start small. Follow the steps above and you’ll build a secure foundation for your Bitcoin journey—without unnecessary risks.

Senate Democrats Raise Alarms Over Proposed Crypto Bill

The world of cryptocurrency continues to evolve rapidly, and lawmakers are scrambling to keep pace with its growth. In the United States, a new proposed bill has sparked significant debate, particularly among Senate Democrats who are raising alarms about potential risks to the financial system. While the bill aims to provide regulatory clarity and boost innovation in the digital asset space, critics argue it could weaken oversight, expose consumers to greater risks, and even destabilize the broader economy.

Understanding the Proposed Bill

The legislation, known as the Responsible Financial Innovation Act (RFIA), is designed to establish clearer rules for digital assets. A key feature of the bill is the classification of certain cryptocurrencies as “ancillary assets,” which would place them under the jurisdiction of the Commodity Futures Trading Commission (CFTC) rather than the Securities and Exchange Commission (SEC).

Proponents of the bill believe that shifting oversight to the CFTC will create a more flexible regulatory framework, encouraging innovation and helping the United States compete globally in the blockchain sector. The bill also seeks to define the roles of federal agencies more clearly, which supporters claim will reduce regulatory confusion for businesses.

Why Democrats Are Sounding the Alarm

Several Senate Democrats, however, have expressed strong reservations. Their concerns focus on three major areas:

- Weakened Investor Protections

By limiting the SEC’s role, the bill may strip away important safeguards that currently protect investors. Democrats argue that the SEC has decades of experience in ensuring transparency, preventing fraud, and holding bad actors accountable—functions the CFTC may not be fully equipped to handle on such a broad scale. - Risk to Financial Stability

Some lawmakers warn that reducing oversight could create loopholes that allow risky financial products to spread unchecked. With more retirement funds, banks, and everyday investors exposed to crypto markets, a sudden downturn or fraud case could trigger wider financial instability. - Systemic Vulnerabilities

Critics also highlight that the CFTC has historically been underfunded and understaffed compared to the SEC. Handing the agency greater responsibility without adequate resources could weaken enforcement and oversight, leaving the system vulnerable to abuse.

Senator Warren’s Vocal Opposition

Senator Elizabeth Warren has been among the most outspoken critics of the bill. She argues that history shows what happens when regulatory safeguards are weakened: financial crises become more likely. Warren and her colleagues warn that the legislation could create a “Wild West” scenario in which consumer protections are overlooked in favor of industry convenience.

Her opposition underscores a broader divide in Congress over how best to regulate crypto. While some lawmakers see the industry as a driver of innovation, others worry that without strong guardrails, it could become a breeding ground for financial instability and corruption.

The Bigger Picture

This debate is not just about cryptocurrency—it is also about the future of financial regulation in the U.S. The outcome of this legislative battle will set a precedent for how emerging technologies are integrated into the economy. If the bill passes in its current form, it could shift the balance of power between regulatory agencies and reshape the relationship between Washington and the crypto industry.

At the same time, the debate highlights the challenge of striking a balance between fostering innovation and ensuring stability. Crypto advocates want freedom to innovate, while skeptics demand strict oversight to protect the public. Finding middle ground may prove to be the hardest task of all.

Conclusion

The proposed crypto bill has opened a new front in the ongoing struggle to regulate digital assets. While its supporters see it as a step toward clarity and innovation, Senate Democrats are warning of serious risks if consumer protections and financial safeguards are weakened. Whether the bill is passed, amended, or rejected, one thing is clear: the stakes are high, not just for the crypto industry, but for the entire U.S. financial system.

What do you think? Should the U.S. prioritize innovation in crypto, or focus on strong regulations to avoid financial risks?