Crypto Market Tanks on Surprise U.S.-China Tariff News

**Crypto Market Crashes After Surprise Tariff Announcement**

A shocking political move has sent waves through global financial markets, causing a massive sell-off across risk assets like cryptocurrencies. Investors rushed to safer options after the announcement of a 100% tariff on Chinese goods, starting November 1st. This unexpected news triggered panic, leading to one of the biggest crypto crashes of the year.

**Bitcoin Plunges Below Key Support Levels**

Bitcoin (BTC) took a heavy hit, falling sharply in just one trading session. On the daily chart, the price dropped below several important levels:

– It lost support at $118,600, which is now acting as resistance.

– It crashed through the 50-day simple moving average (SMA) around $114,500, signaling a big shift in momentum.

– Bitcoin briefly touched $111,350, coming dangerously close to a major support area near $110,000.

The daily candlestick formed a huge red engulfing bar — a clear sign of intense selling and panic across trading platforms. This kind of pattern has marked major breakdowns in the past, but this one stands out due to how fast and deep it was. It’s now officially the worst single-day drop for Bitcoin in 2025.

If the $110K level doesn’t hold, the next key support zones are around $106K (the 200-day SMA) and the psychological $100K mark.

**Crypto Market Loses Over $400 Billion**

Bitcoin wasn’t the only one hit. The entire crypto market saw a major drop. The total market cap crashed by more than 10%, falling from around $4.1 trillion to just above $3.6 trillion before showing a small bounce.

Key points:

– All sectors took damage — DeFi, Layer 2 solutions, AI tokens — nothing was spared.

– Ethereum (ETH) dropped below $4,000 again.

– Major coins like BNB, Solana (SOL), and XRP saw double-digit losses.

– Even strong performers from earlier in October, like Zcash (ZEC) and Bittensor (TAO), gave up most of their recent gains.

This drop also triggered a wave of forced liquidations. Many traders using leverage were wiped out as funding rates turned negative, adding even more pressure to already falling prices.

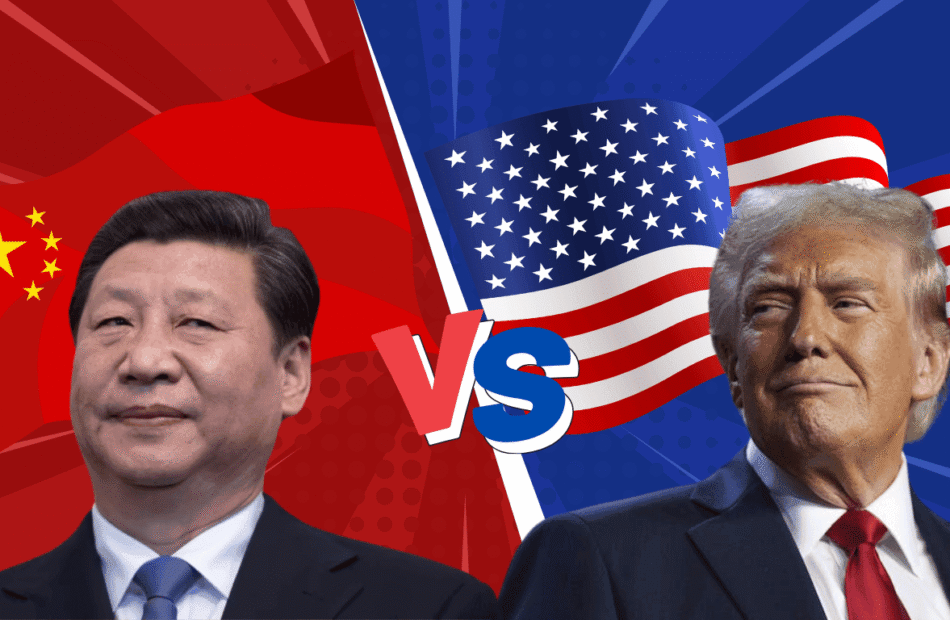

**What Caused the Crash: Fear of Trade War Returns**

The main reason behind this crash was the announcement of steep tariffs on Chinese imports by former President Trump. These new tariffs bring back fears of a global trade war. Investors worry this could hurt supply chains, increase inflation, and damage the overall economy — all things that tend to scare off crypto buyers.

Even though Bitcoin is often seen as a safe haven during global uncertainty, this time investors are playing it safe. Both institutional and retail traders are pulling back from risky assets until there’s more clarity on how the economy will react. And it’s not just crypto — stocks and other markets also fell hard after the news.

**Key Takeaways**

– Bitcoin fell below key support levels and is at risk of more downside if $110K breaks.

– Over $400 billion was wiped from the crypto market in hours.

– All major altcoins and sectors saw steep losses.

– The crash was triggered by fears of a global trade war due to new U.S.-China tariffs.

– Investors are moving to cash and low-risk assets until the economic outlook improves.

This event highlights how sensitive crypto markets still are to global political decisions and macroeconomic uncertainty.