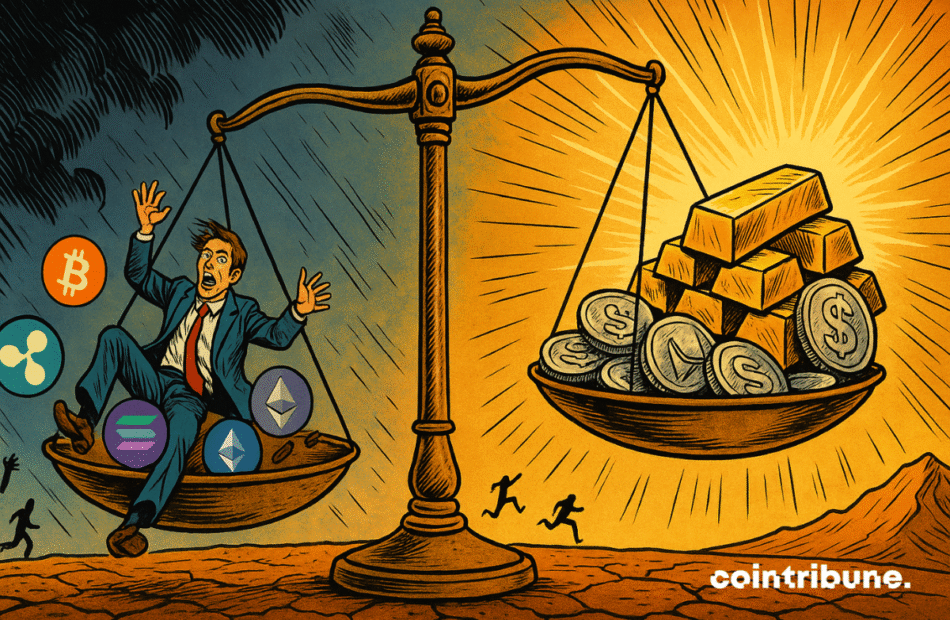

Crypto Dips as Investors Flee to Gold and Silver

The crypto market is currently facing serious turbulence. Bitcoin, the most well-known cryptocurrency, has dropped below the important $100,000 mark—a level many investors see as a psychological threshold. This sharp fall has triggered a chain reaction across the entire digital asset space.

Ethereum is down by 11%, Solana has plunged 20%, and even XRP, which usually holds steady, has dropped 7%. These declines are happening even though the U.S. dollar index is slowing down, a condition that usually supports the crypto market.

According to Greg Magadini, Head of Derivatives Products at Amberdata, the market has simply run out of good news. The Federal Reserve has wrapped up its cycle of lowering interest rates, the U.S. government shutdown is over, and there’s nothing new to boost investor confidence in crypto.

But the bigger risk may come from crypto-heavy companies. Some firms have borrowed large sums to buy Bitcoin using convertible bonds. Now, with credit markets tightening and competition from governments and AI companies for funding, these companies might be forced to sell off their Bitcoin to pay back debts. If that happens, it could spark a domino effect—each forced sale could push other investors to sell too, causing prices to drop even more.

While crypto struggles, gold and silver are having a moment. Investors are turning to these precious metals as safer options. The reason? Many countries are drowning in public debt. Japan’s debt-to-GDP ratio is over 220%, the U.S. is at 120%, and France and Italy both exceed 110%.

Robin Brooks, an expert at the Brookings Institution, says this rush into gold and silver shows how broken fiscal policies have become around the world.

Even other metals like palladium and platinum are seeing gains of over 1%, as investors look for solid assets they can trust. With growing rules and uncertainty surrounding crypto, many prefer metals that have been reliable for decades.

Still, there’s hope for Bitcoin. Historically, there’s about an 80-day delay between gold making a move and Bitcoin following it. Once gold prices level off, Bitcoin might bounce back.

JPMorgan is staying optimistic, predicting that Bitcoin could reach $170,000 within six to twelve months. They base this on the average cost for miners to produce a single Bitcoin, which is around $94,000.

The next few weeks will be key. Whether this is just a temporary dip or the start of a longer downturn depends on how liquidity returns to markets and whether the U.S. gives clearer signals on its monetary policy. For now, though, precious metals remain the top choice for investors looking for safety.