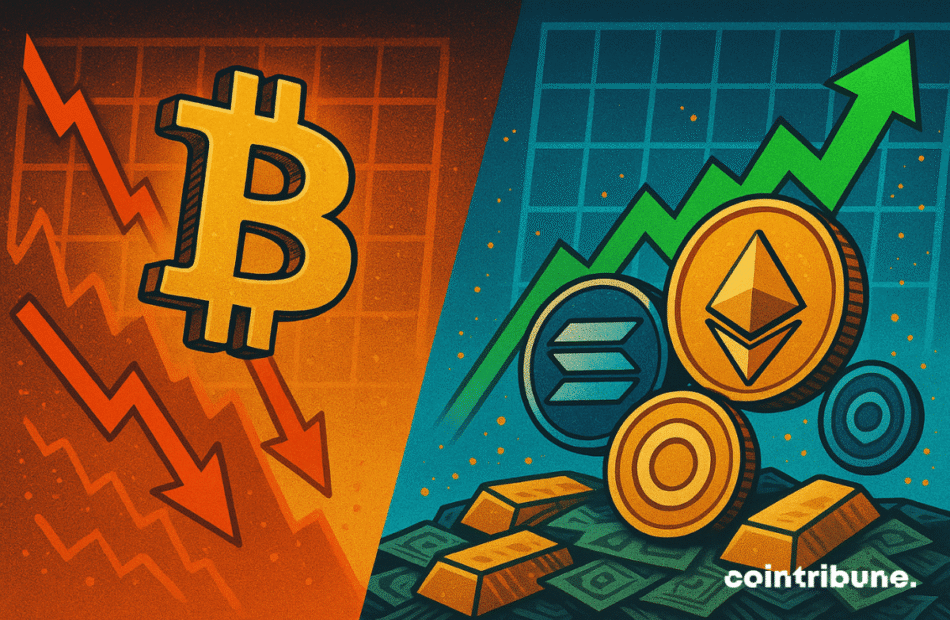

Bitcoin Slows as Altcoins Surge in Market Share

Bitcoin is starting to lose some steam, even though its price moved up slightly to around $117,582. One big sign of this slowdown is that Bitcoin’s trading volume dropped 28% over the past week. That means fewer people are buying and selling it, even with the price going up a bit. Some experts think money might be quietly moving into altcoins — other cryptocurrencies besides Bitcoin.

Even with less trading activity, Bitcoin’s total market value (market cap) inched up to $2.34 trillion. But it’s still below last week’s all-time high of $124,000. Historically, August has been a slower month for Bitcoin, and if this trend continues, there’s a chance the price could dip back down to around $116,000.

Another red flag is Bitcoin’s shrinking dominance in the crypto market. Back in May, Bitcoin made up 65% of the total crypto market. Now, it’s fallen below 59%. This drop suggests that investors are spreading their money into altcoins like Ethereum, Solana, and tokens tied to artificial intelligence (AI) and decentralized finance (DeFi).

These altcoins have been gaining momentum. Over the past month, their combined market value jumped by more than 50%, reaching about $1.4 trillion. This shift shows growing interest in crypto beyond just Bitcoin.

Big financial players are starting to take notice. Coinbase Institutional said this week that we might be entering a full-on “altcoin season.” For example, Ethereum’s trading volume spiked 300% in the past month alone. As Bitcoin’s price becomes more stable, more investors are feeling confident enough to explore smaller and riskier digital assets.

What happens in the next few weeks could shape how the crypto market looks heading into 2025. Investors are watching closely to see if this altcoin rally continues or if Bitcoin makes a strong comeback.