AI Predicts Big Gains for XRP, ADA, and SOL by 2026

**Disclaimer**: Crypto is a high-risk investment. This article is for informational purposes only and not financial advice. You could lose all your money.

—

**DeepSeek AI Predicts Big Gains for XRP, Cardano, and Solana by 2026**

A powerful AI model from China, DeepSeek AI, has shared bold predictions for the future prices of top altcoins like XRP, Cardano (ADA), and Solana (SOL). These forecasts assume a strong bull market powered by better U.S. crypto regulations and growing institutional interest.

Let’s break down the outlook for each coin.

—

**XRP Price Forecast: Could Reach $10 by 2026**

XRP, the token linked to Ripple, started 2026 strong with a 19% price jump in just the first week of January. Currently priced around $1.89, DeepSeek AI believes XRP could hit $10 by the end of 2026. That would be over a 5x return—more than 430% gains.

XRP gained huge momentum in 2023 after Ripple won a major legal battle against the U.S. Securities and Exchange Commission (SEC). This victory cleared up a lot of regulatory confusion and helped restore investor confidence.

XRP also got a boost from political changes, especially with pro-crypto leaders returning to power in the U.S., which encouraged more positive sentiment in the crypto space.

On the technical side, XRP is forming a bullish flag pattern—a chart signal that often leads to big price moves. If market conditions stay favorable and regulation becomes clearer, XRP could easily hit DeepSeek AI’s $10 target.

Adding to this momentum, new spot XRP ETFs have launched in the U.S., attracting interest from traditional finance investors—similar to what happened with Bitcoin and Ethereum ETFs.

—

**Cardano (ADA) Price Forecast: $12 Target by 2026**

Cardano (ADA) is known for its academic approach to blockchain. Founded by Ethereum co-creator Charles Hoskinson, Cardano focuses on security, scalability, and sustainability through peer-reviewed development.

Currently trading near $0.36, DeepSeek AI predicts ADA could soar to $12 by early 2026. That’s a potential gain of over 3,200%—a massive increase from its previous all-time high of $3.09 during the 2021 bull run.

Despite trading at one of its lowest points since October 2024, Cardano’s strong developer activity and growing ecosystem keep it relevant as a top Ethereum competitor. Its total value locked (TVL) stands at over $164 million, with continuous growth in decentralized apps (dApps).

While ADA could face short-term pressure if the broader economy weakens, crypto regulation is now a key focus in U.S. politics—making a more positive outcome likely.

—

**Solana (SOL) Price Forecast: Could Hit $600 by 2027**

Solana (SOL) is one of the fastest-growing smart contract platforms. It’s known for speed and low fees and currently has over $8.2 billion in total value locked. SOL’s market cap is now above $72 billion with rising activity from developers and users alike.

SOL is trading around $128 after a recent correction but has held strong support at this level. A breakout could happen if Bitcoin climbs above $100,000—something many analysts expect soon.

DeepSeek AI’s most optimistic forecast sees Solana reaching $600 by 2027. That would mean a gain of nearly 370%, doubling its previous all-time high of $293 set in early 2025.

Institutional interest is also growing fast. Companies like Franklin Templeton and BlackRock are exploring real-world asset tokenization using Solana’s network—signaling more mainstream use cases ahead.

—

**Maxi Doge (MAXI): The Meme Coin Built for Wild Swings**

Beyond major altcoins, meme coins continue to attract attention—and Maxi Doge ($MAXI) is leading the pack in early 2026.

MAXI is a new meme coin inspired by Dogecoin but with an edgy, gym-bro twist. It’s bold, loud, and designed for traders who love risk and volatility. So far, it has raised over $4.5 million in its ongoing presale.

MAXI runs on Ethereum as an ERC-20 token using proof-of-stake—making it more eco-friendly than Dogecoin’s older proof-of-work model.

Early buyers can stake their MAXI tokens for up to 69% APY (annual percentage yield), though rewards drop as more people join the staking pool. The current presale price is $0.0002795 and automatically increases at each funding stage.

MAXI has gained a strong following on social media, with many calling it the new king of meme coins as it builds its own “Maxi Doge Army.”

—

**Final Thoughts**

DeepSeek AI’s crypto price forecasts suggest massive upside potential for XRP, Cardano, and Solana if bullish trends continue and regulations improve. Meanwhile, meme coins like Maxi Doge are capturing attention with high-risk, high-reward opportunities.

Stay tuned as crypto enters an exciting new phase driven by AI predictions, clearer rules, and growing institutional interest.

Husky Inu AI Rises in Pre-Launch as Crypto Market Dips

**Husky Inu AI (HINU) Sees Price Bump in Pre-Launch Phase**

Husky Inu AI (HINU), a new AI-driven cryptocurrency, has just completed another price increase in its pre-launch phase. The token moved up from $0.00025539 to $0.00025636. This gradual price rise is part of a planned rollout that started on April 1, 2025, after the project’s presale officially ended.

The pre-launch phase serves several purposes. It allows the Husky Inu AI team to continue raising funds, improve the platform, and grow the community before the full launch. It also gives early investors more time to get involved. The official launch is expected within three months, but the team has left room for flexibility depending on how the market performs.

To decide the final launch date, the team is holding regular review meetings. Two meetings have already taken place — one on July 1 and another on October 1, 2025. The next one is scheduled for January 1, 2026. So far, Husky Inu AI has raised $922,464, with expectations high that it will break the $1 million mark before launch.

**Crypto Market Struggles as Legislation Delays Weigh Down Momentum**

The wider crypto market hit a speed bump over the past 24 hours as hopes of a recovery faded. A major reason? The U.S. Senate Banking Committee has delayed its crypto market structure bill indefinitely. This delay has created uncertainty for investors and weakened recent gains.

Even though former President Trump dialed back some tariff threats on European allies, that positive news wasn’t enough to push crypto prices up. Investors remain cautious, and most major coins are struggling.

Bitcoin (BTC), for example, dropped to a low of $88,632 before climbing back to $89,882. However, it couldn’t hold above $90,000 and settled at around $89,549 — still down slightly over the last day. Ethereum (ETH) also dipped, hitting a low of $2,910 before recovering to $2,963 — a 1.43% drop in 24 hours.

Other popular altcoins also saw red. Ripple (XRP) is down nearly 2%, hovering around $1.91 after falling below the key $2 level. Solana (SOL) dropped about 1% to $128. Dogecoin (DOGE) and Cardano (ADA) had similar drops, while Chainlink (LINK) slipped by 0.65% to about $12.35.

Additional losses were seen in Stellar (XLM), Hedera (HBAR), Toncoin (TON), and Polkadot (DOT). The only standout was Litecoin (LTC), which went against the trend and gained nearly 1%.

**Bitcoin Still Underperforming Compared to Gold and Silver**

Bitcoin’s performance is raising eyebrows among analysts and investors. While traditional assets like gold and silver are breaking records — with gold hitting $4,930 per ounce and silver climbing to $96 — Bitcoin has failed to keep up. It dropped as low as $87,000 before rebounding to $89,000, still well below its October all-time high of $126,000.

Some experts are questioning whether Bitcoin’s recent growth story is losing steam. Jim Bianco from Bianco Research pointed out that BTC needs a new driving theme or narrative to regain momentum.

On the other hand, Bloomberg ETF analyst Eric Balchunas offered a more optimistic view. He reminded investors that Bitcoin surged from $16,000 in late 2022 to over $120,000 by October 2025 — a massive 300% gain over 20 months. A bit of cooling off is natural after such a big run.

Balchunas also suggested that early investors may be cashing out profits now, which could explain the current slowdown.

**Stay Connected With Husky Inu AI**

For more updates on Husky Inu AI (HINU), check out their official channels:

– Website: Husky Inu Official Website

– Twitter: Husky Inu Twitter

– Telegram: Husky Inu Telegram

Disclaimer: This content is for informational purposes only and does not serve as financial or investment advice.

Galaxy Launches $100M Crypto Hedge Fund Amid Market Dip

**Galaxy Launches $100 Million Crypto Hedge Fund Despite Market Dip**

In a strong signal that big investors are still interested in crypto, Galaxy is moving ahead with a new $100 million hedge fund—even as the overall crypto market faces a recent pullback.

**Galaxy’s New Crypto Hedge Fund Explained**

Galaxy, the digital asset company started by billionaire Mike Novogratz, is launching a $100 million hedge fund focused on trading both cryptocurrencies and stocks related to the blockchain space. This new fund is set to launch in the first quarter of the year and is designed to make money whether prices go up or down.

Unlike traditional crypto investment products that only profit when prices rise, this fund uses a long/short strategy. That means it can bet on both gains and losses, giving it more flexibility—especially useful during times when crypto prices are falling.

The fund will be part of Galaxy’s larger asset management division, which currently handles about $17 billion in digital assets. This marks a more focused effort by Galaxy to invest in public markets that are connected to blockchain trends.

**What the Fund Will Invest In**

The new hedge fund will use a mixed strategy. About 30% of its portfolio will go directly into crypto tokens like Bitcoin and Ethereum. The rest will be invested in financial stocks that are closely tied to crypto, such as companies in payments, banking, and trading that are using or being affected by blockchain technology.

This mix allows the fund to take advantage of both direct crypto growth and stock market opportunities created by the spread of blockchain. It also gives the fund managers more tools to deal with changing rules, market setups, or big economic shifts that might affect listed companies.

So far, the fund has already raised the full $100 million from wealthy individuals, family offices, and institutional investors. There’s still room for more investments before it officially launches, depending on interest and available space.

Galaxy will also invest its own money into the fund to show commitment and align its interests with outside investors.

**Why Launch Now?**

This fund is launching at a tricky time for crypto. Bitcoin has fallen around 28% from its recent high and is trading near $90,000. This week alone, it dropped about 5%, showing how volatile the market is right now.

The recent dip is partly due to global trade concerns after political tensions flared up. As a result, investors are feeling nervous, especially around riskier assets like crypto—even though traditional markets have stayed fairly stable.

Despite this uncertainty, Galaxy believes now is actually a good time for active strategies like this hedge fund. Being able to bet both ways—on prices rising or falling—can help reduce risk while still offering growth potential.

**Meet the Fund Manager: Joe Armao**

Joe Armao will lead the new hedge fund. He believes the easy money days in crypto might be over, but he still sees major tokens like Bitcoin, Ethereum, and Solana as smart long-term investments for institutional investors.

Armao says that as interest rates possibly start falling and regular markets stay steady, Bitcoin could continue to play an important role in investment portfolios. He also thinks that a flexible long/short approach is better suited to handle changing rules, liquidity levels, and macroeconomic shifts than just holding onto tokens.

This new fund will look for winners and losers across the entire digital asset world—from crypto platforms and banks to fintech firms and software companies being impacted by blockchain and AI trends.

**Galaxy’s Bigger Plans: Tokenized Credit and Blockchain Finance**

Galaxy has come a long way since Novogratz first started it as a pure hedge fund nearly a decade ago. Now it’s a full-service digital finance firm involved in crypto investing, trading, and asset management. Last year alone, Galaxy reported $505 million in profits in just one quarter.

Alongside the new hedge fund, Galaxy is also making moves in blockchain-based credit markets. The company recently completed a $75 million deal for its first tokenized collateralized loan obligation (CLO), which lets traditional credit investors access private loans using blockchain tech.

A major portion of that deal—about $50 million—came from Grove Finance, showing that institutional players are becoming more interested in blockchain-based financial products. This move fits into Galaxy’s broader strategy of combining old-school finance with new decentralized tools.

**Why This Matters for Institutional Crypto Growth**

Galaxy’s launch of this new hedge fund shows that large investors still believe in crypto—even when prices are down. Hedge fund strategies like this one, which can profit in both directions, are appealing to institutions looking for smart ways to manage risk while gaining exposure to digital assets.

For the broader market, this launch highlights how professional investors are developing more advanced ways to invest in crypto. If Galaxy’s fund does well during these volatile times, it could help convince more institutions to get involved in digital assets—and support the continued growth of crypto as a serious asset class.

In short, Galaxy is using today’s uncertain market conditions as an opportunity to introduce a more adaptable crypto hedge fund while expanding into tokenized finance—setting itself up for success in the next wave of digital finance innovation.

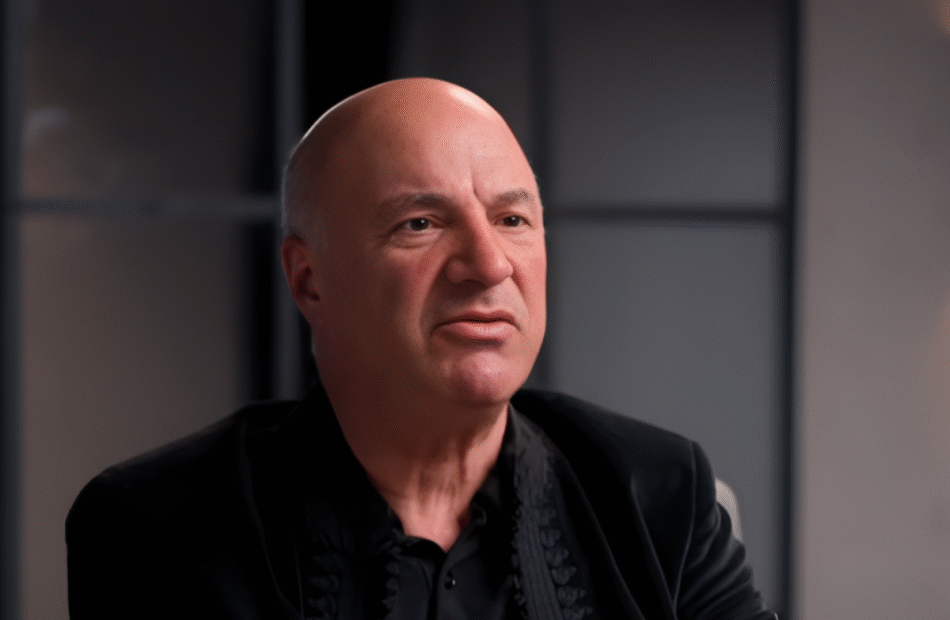

Kevin O’Leary Invests 20% in Crypto and Data Centers

Kevin O’Leary Puts Nearly 20% of His Portfolio Into Crypto and Infrastructure Projects

Well-known entrepreneur and Shark Tank investor Kevin O’Leary has revealed that he’s getting serious about crypto — not just in buying digital coins, but by investing heavily in the infrastructure needed to support it. O’Leary now has around 19% of his total investment portfolio tied to crypto-related assets. He’s focusing on building out the backbone of the industry, especially in areas like bitcoin mining and AI-powered data centers.

Owning 26,000 acres of land across various locations, O’Leary is preparing these sites to become power-ready zones where companies can set up bitcoin mining operations or data centers. Half of this land — about 13,000 acres — is in Alberta, Canada. The rest is located in undisclosed places still waiting for permits. Once he gets the go-ahead, O’Leary plans to lease the land to companies that need affordable, utility-ready spaces to operate.

He explained that his goal isn’t to build data centers himself. Instead, he wants to make sure the land is fully permitted and ready for construction — what he calls “shovel-ready.” According to O’Leary, many of the data centers announced in recent years will never be built because developers underestimated how complex and expensive the process can be. For him, this is more than just a business move — it’s a strategic “land grab” for future tech infrastructure.

These sites are being set up with full utilities, making them ideal for bitcoin mining right away and potentially valuable for other uses, like government-run data centers, in the future. O’Leary pointed out that in some areas, the deals he’s made for low-cost electricity — under six cents per kilowatt-hour — are even more valuable than owning bitcoin itself. In his view, having access to cheap power is critical for long-term success in both crypto mining and AI operations.

When it comes to his crypto holdings, O’Leary said he’s been careful due to the market’s wild price swings. Still, he holds a significant portion of his portfolio in crypto-linked assets. He believes that serious investors only need to focus on bitcoin and ethereum. In fact, he says these two coins account for over 97% of the entire market’s movement. All the smaller cryptocurrencies — which he jokingly calls “poopoo coins” — are still down by as much as 90% and are unlikely to recover.

His viewpoint lines up with a recent report from Charles Schwab, which found that around 80% of the total $3.2 trillion cryptocurrency market is concentrated in bitcoin and ethereum. Even though thousands of new crypto projects launch every year, most of the real value is still in these two major players.

O’Leary also emphasized that regulation will shape the future of crypto. A key piece of legislation currently being reviewed in the U.S. Senate could have a big impact. One part of the bill would ban yield on stablecoin accounts — something O’Leary sees as unfairly benefiting traditional banks over crypto platforms. However, he’s hopeful that this will be revised before becoming law. Overall, he thinks clear regulations will help bring more institutional investors into the crypto space.

Keywords: Kevin O’Leary crypto investments, bitcoin mining infrastructure, AI data centers, land for data centers, utility-ready sites, low-cost electricity for bitcoin mining, bitcoin and ethereum portfolio strategy, crypto market regulation, stablecoin yield ban, institutional investment in crypto.

Binance Delists 19 Low-Volume Spot Trading Pairs

**Binance Removes 19 Spot Trading Pairs in Market Cleanup**

Binance, one of the largest cryptocurrency exchanges in the world, is making changes to its spot trading market. Starting January 23 at 3:00 a.m. UTC, Binance will remove 19 trading pairs. These include popular combinations like BTC (Bitcoin) and ETH (Ethereum) with other crypto tokens. The affected tokens include Lido (LDO), Filecoin (FIL), dYdX (DYDX), Yearn Finance (YFI), and meme coins like Book of Meme (BOME) and Peanut (PNUT).

**What’s Changing?**

The tokens themselves are not being removed from Binance. You can still buy, sell, and trade them. What’s changing is that you won’t be able to trade these specific pairs directly—for example, no more LDO/BTC or DYDX/FDUSD. These pairs are being removed because they either don’t have enough trading activity or they overlap with other more popular pairs.

**List of Removed Trading Pairs Includes:**

– AI/BTC

– FIL/ETH

– DYDX/FDUSD

– LRC/ETH

– XVG/ETH

– YFI/BTC

… and more

**Why Binance Is Doing This**

Binance says the goal is to improve “market quality.” That means they want to clean up low-volume trading pairs that don’t get much use. This helps the exchange run more smoothly and ensures better prices for most traders. Removing rarely used pairs also helps reduce confusion and makes it easier for users to find high-liquidity options.

**Impact on Traders**

If you use BTC or ETH trading pairs for strategies like arbitrage, liquidity routing, or hedging, this change might affect you. With fewer direct trading paths between tokens, some trading strategies may need to be adjusted. However, most of the affected tokens will still be available through major pairs like USDT, BNB, and FDUSD. That means overall price discovery and trading volume should stay strong.

**What Happens to Trading Bots?**

If you’re using trading bots linked to any of the removed pairs, Binance will automatically shut them down once the delisting takes effect. It’s a good idea to manually cancel or reconfigure your bots before January 23 to avoid unexpected issues.

**Focus on DeFi, Meme, and Infrastructure Tokens**

The tokens involved come from various parts of the crypto world. These include:

– DeFi tokens: Lido (LDO), dYdX (DYDX), Yearn Finance (YFI)

– Meme coins: Book of Meme (BOME), Peanut (PNUT)

– Infrastructure projects: Filecoin (FIL), Zilliqa (ZIL), Verge (XVG)

– Others: Ethena (ENA), Numeraire (NMR)

Even though some of their trading pairs are being removed, these tokens remain fully supported on Binance for deposits, withdrawals, and trading through other active pairs.

**Simplifying the Trading Experience**

This move is part of Binance’s effort to simplify its platform by focusing on pairs that have strong demand and high liquidity. By trimming down low-volume options, Binance wants to improve the overall user experience and make trades easier and faster to execute.

**What Should Traders Do?**

If you hold or trade any of the affected assets through the soon-to-be-delisted pairs, check your strategies and adjust accordingly. You may need to switch to trading those tokens against USDT, BNB, or FDUSD instead.

In short, Binance is cleaning up its trading pairs to focus on what works best for most users. While some advanced traders may feel limited by fewer BTC and ETH pairings, the broader trading experience should become more efficient and easier to navigate.