Grayscale Cardano ETF Sparks ADA Surge; Unilabs Soars

Big news hit the crypto world on August 12th when Grayscale, one of the largest digital asset management companies, filed for a Cardano ETF in Delaware. This move caused Cardano’s price (ADA) to jump by 30%, quickly rising to $1 within just three days.

Cardano is not the only project making waves. A new platform called Unilabs Finance is shaking things up in decentralized finance (DeFi). Using advanced AI technology, Unilabs aims to change how people invest in crypto. It’s currently in stage 7 of its presale and has already raised over $13.8 million.

Many experts think ADA could see another big price jump if the Cardano ETF gets approved. However, they also believe Unilabs Finance could outperform Cardano with a massive 14,200% price rally during this bull market.

Grayscale has already launched ETFs for Bitcoin and Ethereum. Now, by moving forward with a Cardano ETF, they’re signaling strong interest in ADA. After the announcement, ADA broke through the $0.90 resistance level. Even though it has slowed a bit, it’s still holding above $0.90 and is currently trading around $0.9168 after a small 4% drop in the past 24 hours.

Market sentiment is turning bullish, and analysts now say there’s an 80% chance that the Cardano ETF will be approved by 2025. The MACD indicator also shows growing buying pressure for ADA. The next key resistance is around $0.97, with a major psychological barrier at $1. If ADA can break above these levels, it may push up to $1.25 and even reach $2 by late 2025.

Still, while Cardano has been a top-10 crypto project for a long time, many investors are now focusing on Unilabs Finance. This platform is offering something new — AI-powered investment tools that help everyday users navigate the complex world of crypto investing.

Unilabs has created tools like AI Market Pulse, which scans thousands of crypto projects using on-chain data, volume trends, and social media sentiment to find the best-performing coins. Another feature, the Early Access Scoring System, ranks new crypto projects based on factors like real-world use cases, team strength, community buzz, and token economics.

While ADA may double in price with ETF approval, its potential is more limited because it’s already an established project. On the other hand, Unilabs Finance is still early in its journey and has far more room to grow. That’s why experts believe it could deliver huge returns — possibly over 14,200% — as more investors discover its AI-driven approach to DeFi asset management.

With Grayscale pushing for a Cardano ETF and growing interest in ADA, we could see prices near $2 by year-end. But many analysts are betting on Unilabs Finance as the stronger long-term play. Its innovative tools and early-stage growth make it one of the most promising AI-powered crypto projects in today’s market.

Bitmine Bets Big on Ethereum, Boosting SUBBD Token

Big money is moving fast into crypto, especially as we head into the fall. One of the most aggressive players in the space right now is Bitmine. Since launching in 2019, Bitmine has built up a massive $6.6 billion crypto portfolio, making it one of the largest digital asset treasuries in the world.

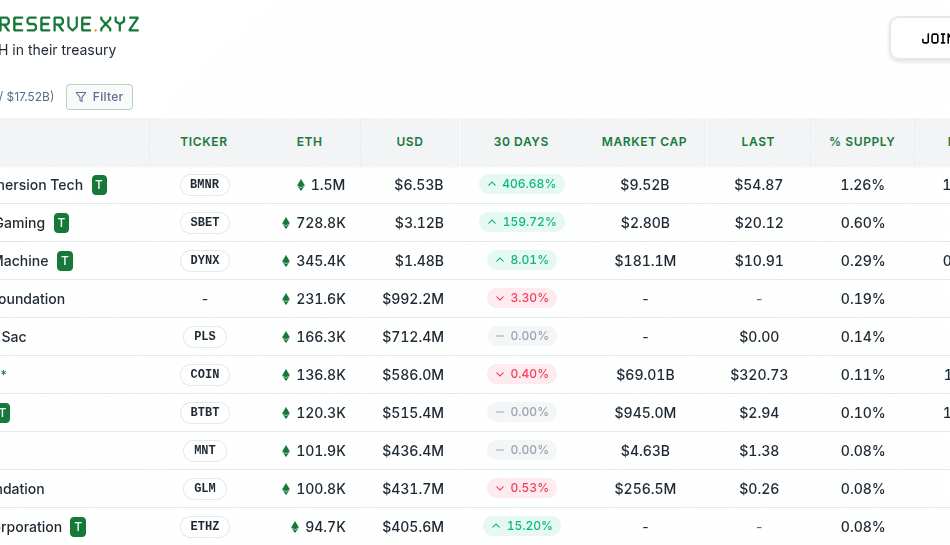

But unlike most big funds that go all-in on Bitcoin, Bitmine is taking a different route. They’re betting big on Ethereum ($ETH). Just last week, Bitmine increased its Ethereum holdings from 1.15 million ETH to 1.5 million ETH. That’s a jump of $1.7 billion in value. This now makes Bitmine the largest holder of Ethereum in the world and the second-largest crypto treasury overall—right behind MicroStrategy, which is still focused only on Bitcoin.

Bitmine’s bold goal? To own 5% of all Ethereum in circulation. According to Chairman Tom Lee, they want to become the “MicroStrategy of Ethereum.”

As more institutional investors like Bitmine load up on Ethereum, it’s becoming clear that Ethereum is no longer just a platform—it’s becoming the go-to blockchain for serious use cases like decentralized apps (dApps) with real-world value. Some experts believe Ethereum could hit $15,000 soon, and when that happens, projects built on Ethereum—like SUBBD Token ($SUBBD)—stand to gain a lot.

SUBBD isn’t trying to change crypto itself—it’s targeting the massive $85 billion creator economy. It uses Ethereum’s tech to give content creators AI-powered tools that let them interact with fans in smarter and more direct ways.

Before diving deeper into SUBBD, let’s look more closely at Bitmine’s strategy.

Bitmine believes Ethereum’s smart contracts will be the backbone of future digital finance. While MicroStrategy continues to build its Bitcoin-only fund—currently holding 629,000 BTC worth about $72 billion—Bitmine is going all-in on Ethereum. Their focus outpaces other Bitcoin-focused funds like Mara Holdings, which holds around $5.8 billion in BTC.

This is a big shift in the crypto world. Bitcoin has long been seen as digital gold—a way to store value. But now, Ethereum is emerging as a powerful tool for real-world asset tokenization, especially as major players like BlackRock explore blockchain for things like bonds and commodities.

What’s surprising is how quickly Bitmine has moved. They gathered their entire 1.5 million ETH stash in just two months—a much faster pace compared to MicroStrategy, which has been buying Bitcoin slowly since 2020.

Still, Bitmine hasn’t completely abandoned Bitcoin. They currently hold 192 BTC, worth around $22 million today. But their aggressive move into Ethereum shows they have strong confidence in ETH’s future growth.

That’s great news for Ethereum-based platforms like SUBBD.

SUBBD is a Web3 platform built entirely on the Ethereum blockchain. It lets content creators connect directly with their fans—no middlemen, no high fees. Fans can use SUBBD Token ($SUBBD) to tip creators or buy personalized content without paying credit card fees or platform cuts. More money goes directly into creators’ pockets.

But SUBBD is more than just a payment system. It offers AI-powered tools that help creators produce custom voice notes, photos, and videos. The platform’s smart AI assistants handle editing and monetization, so creators can focus on making content fans actually want.

The entire system runs on the SUBBD Token ($SUBBD). It gives users access to exclusive content and features and offers staking rewards—right now at a flat 20% until the end of the token presale.

The early version of the SUBBD platform is already live, and the full release is coming in Q3 2025. The presale has already raised over $1 million, and the current token price is $0.056225. Prices will rise as launch day gets closer.

With Bitmine aggressively buying up Ethereum and aiming for 5% of all ETH tokens, other funds like SharpLink and The Ether Machine are now racing to keep up. This growing competition means more attention—and more value—for the Ethereum network and the projects built on it.

That includes platforms like SUBBD Token ($SUBBD), which could see major growth as Ethereum adoption spreads.

Just remember: all investments come with risk. Crypto prices can go up or down. Always do your own research and only invest what you can afford to lose.

Bitfarms Stock Drops 7% Amid Crypto Market Sell-Off

Bitfarms Inc. (BITF) shares dropped sharply on Tuesday, following a major downturn in the cryptocurrency market that pulled down many crypto-related stocks.

The main reason behind the drop was a broad sell-off in digital currencies. Bitcoin, the largest cryptocurrency, fell by 5.3% and slipped below its 50-day moving average — a key technical level that many traders use to track short-term trends. This move erased some of Bitcoin’s recent gains and triggered more selling across the entire crypto space.

Other cryptocurrencies also took a hit. Ethereum dropped 4.5%, Solana fell 2.7%, and Cardano tumbled more than 6%. In total, the crypto market lost around $110 billion in value in just one day. This sudden decline raised fears that investors are turning more cautious and bearish in the short term.

The slump in cryptocurrencies came alongside weakness in the broader stock market. Tech stocks were hit especially hard. The Nasdaq 100 fell by 1.4%, its worst drop in over two weeks. The S&P 500 also dipped 0.5%, while the small-cap Russell 2000 lost 0.9%. High-growth tech stocks, such as Palantir, saw steep declines — Palantir shares dropped more than 8% after a strong run earlier this year.

There were two big reasons behind this market pullback:

1. Ongoing global tensions — peace talks involving former U.S. President Donald Trump, Ukrainian President Volodymyr Zelenskyy, and European leaders didn’t make any progress, adding uncertainty to an already fragile global situation.

2. Investors are waiting to hear from Federal Reserve Chair Jerome Powell about interest rates, making traders nervous and less willing to take risks in markets like crypto.

Bitfarms, a company that earns money by mining Bitcoin and building blockchain infrastructure, was directly affected by this crypto sell-off. As Bitcoin prices fell and market volatility increased, Bitfarms stock followed suit. Investors are now worried about how profitable these companies will be in the near future if crypto prices remain under pressure.

The mix of falling Bitcoin prices, global uncertainty, and a shift away from risky investments caused Bitfarms stock to drop by over 7%, closing at $1.278 on Monday.

Keywords: Bitfarms, BITF stock, Bitcoin price drop, cryptocurrency market crash, Ethereum decline, Solana price fall, Cardano news, crypto sell-off, Nasdaq down, tech stock losses, Palantir drop, Jerome Powell interest rates, global geopolitical tensions, blockchain infrastructure, Bitcoin mining companies, crypto stock performance

Toyota Unveils MON: Blockchain Platform for Mobility

Toyota is stepping into the future of mobility with a new blockchain-based system called the Mobility Orchestration Network (MON). Developed by Toyota Blockchain Lab, this innovative platform is built on Avalanche (AVAX), a high-speed and scalable blockchain network. MON is designed to bring trust, transparency, and better coordination to the global transportation industry.

At its core, MON acts like a digital layer that connects various players in the mobility ecosystem—car makers, government regulators, infrastructure providers, and everyday users. By using blockchain technology, it creates a secure environment where data can be verified and shared without relying on one central authority.

The MON prototype is made up of four main parts:

1. **Avalanche Blockchain Layer** – This is the foundation. It records and verifies all transactions quickly and securely.

2. **Data Access & Control Layer** – Manages who can see or use different types of data across the system.

3. **Mobility Services Layer** – Supports real-world applications like payments, insurance processing, carbon tracking, and sharing vehicle data.

4. **Interface Layer** – Connects apps and external systems to the MON platform so users and companies can interact easily.

Toyota chose Avalanche for its fast transaction speeds (finalizing in less than a second), ability to handle large volumes of data, and strong interoperability features—essential for handling things like ride-sharing payments, EV charging records, and insurance claims.

The goal behind MON is to fix some major problems in today’s transportation world: scattered data systems, poor communication between industries, and a lack of shared standards. With MON, important data like vehicle usage, carbon credits, or smart contracts can be shared securely and transparently.

This project is part of Toyota’s long-term vision to build a trustworthy digital infrastructure for the mobility industry. If MON is widely adopted, it could become a blueprint for how transportation systems around the world use blockchain to improve efficiency and trust.

In the bigger picture, MON shows how blockchain—especially platforms like Avalanche—can create what’s called “programmable trust.” This means companies can work together more easily while giving consumers better access to services without worrying about data security or central control.

Keywords: Toyota Blockchain Lab, Mobility Orchestration Network (MON), Avalanche blockchain, AVAX, blockchain in mobility, transportation technology, mobility ecosystem, programmable trust, secure data sharing, smart contracts for EVs, decentralized mobility platform.

$290M Liquidated as Crypto Market Sees Sharp Drop

Over $290 million in crypto positions were wiped out in the last 24 hours, as a sharp market drop triggered a wave of liquidations. Bitcoin (BTC) and Ethereum (ETH) both saw big losses, pushing many traders—especially those using high leverage—into deep red territory.

Bitcoin briefly dropped to $113,000, while Ethereum slipped below $4,200. This sudden dip caused over-leveraged positions in BTC and ETH to crash on major derivatives platforms. Many traders, including some big-name whales, saw millions vanish as the market turned against them.

One notable example is Machi Big Brother, a well-known figure in the crypto and NFT world. He opened a massive $100 million ETH trade with 25x leverage at a price of $4,585.5 using the trading platform HyperLiquid. To keep that position open, he put up more than $4 million in margin. But with Ethereum now far below his entry price, he’s already down over 230%, and his liquidation price is hovering around $3,000.

Machi also placed a 40x leveraged bet on Bitcoin, which has now lost around 95% of its value, costing him over $544,000. On top of that, he has smaller bets on altcoins like HYPE and PUMP—both of which are also deep in the red. His positions in these coins added another $500,000 in unrealized losses.

The HYPE token, which is native to the HyperLiquid platform, is facing serious resistance and might drop further if current trends continue. Crypto analysts like Ali Martinez predict that HYPE could fall below $39 if the bearish momentum continues. Meanwhile, PUMP—a newer meme coin—has fallen 59% from its July peak despite gaining attention on social media.

This recent market shake-up is a harsh reminder of the risks involved with using high leverage in crypto trading. Even seasoned investors can face massive losses when the market moves quickly against them.

Trending in crypto:

– WEMIX Token spikes 11% after launch of Legend of Ymir pre-registration

– Pi Network invests $100M in AI tech as Pi Coin nears key price level