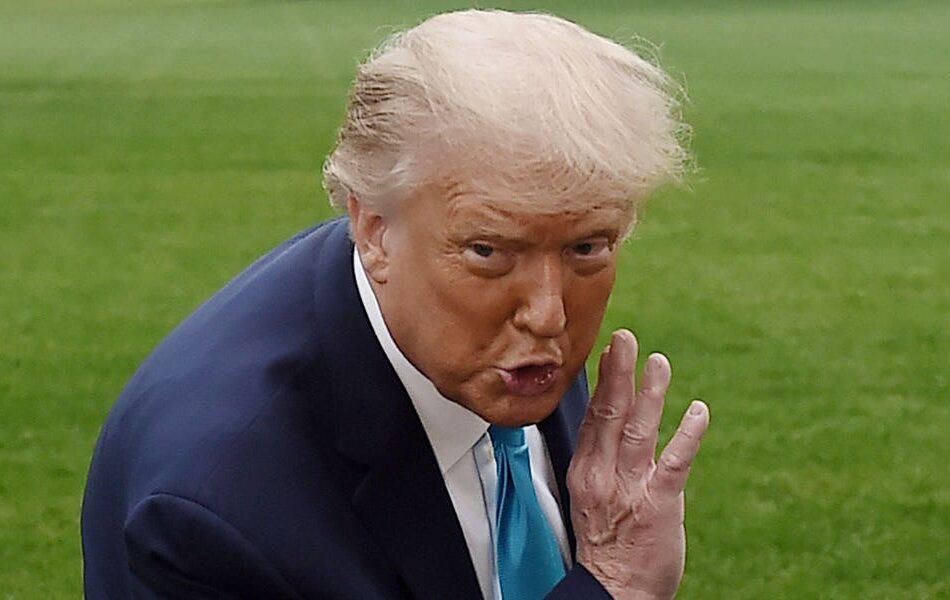

Trump Pushes Blockchain, Slams Fed Over Interest Rates

Donald Trump is stepping up his attacks on the Federal Reserve, especially targeting Fed Chair Jerome Powell. Trump has accused Powell of making bad decisions, and many economists are now warning that the U.S. dollar could face serious trouble ahead.

Trump has even suggested firing Powell and removing Fed governor Lisa Cook, raising concerns about whether the Fed can remain independent from political influence.

At the same time, something new and surprising is happening in Washington. The U.S. Commerce Department, under Trump’s leadership, has started publishing official economic data directly onto blockchains like Bitcoin and Ethereum. This move is shaking up how economic information is shared—and it might even change how interest rates are set in the future.

This week, tech investor Chamath Palihapitiya explained on the All In Podcast that the Commerce Department has started recording GDP (Gross Domestic Product) data on several major blockchains. These include Bitcoin, Ethereum, Solana, Tron, Stellar, Avalanche, Arbitrum, Polygon, and Optimism. The data also goes through crypto oracles like Pyth and Chainlink, which help apps access real-time financial info.

Palihapitiya said this could be the beginning of a huge shift—one where markets use real-time data to set interest rates on their own, without waiting for the Fed.

The Commerce Department called this blockchain move a “landmark effort” to show how powerful and useful blockchain technology can be. It’s part of Trump’s push to make the U.S. the global leader in blockchain innovation.

U.S. Secretary of Commerce Howard Lutnick said publishing GDP numbers on the blockchain makes America’s economic data permanent and available to everyone around the world. He praised Trump as “the crypto-president” for pushing this forward.

Lutnick also announced plans to expand this blockchain system across all government departments. Eventually, all official statistics—like job numbers, inflation data, and more—could be published on blockchains for full transparency.

Palihapitiya added that even private payroll and financial data might be included in the future. This would allow real-time market reactions and smarter pricing by using accurate data, without waiting for outdated reports from the Fed.

This all comes as tensions rise between Trump and the Federal Reserve. Critics say Powell misjudged inflation after COVID-19 by calling it “temporary” and delaying interest rate hikes. Things got worse when Powell raised rates by 50 basis points in September last year—a move some saw as helping Trump’s political opponents.

On the podcast, investor David Sacks accused Powell of playing favorites, saying he’s willing to cut rates for Biden or Harris but not for Trump. Sacks used Trump’s nickname for Powell—“Too Late Powell”—to mock his slow decision-making.

Palihapitiya believes the free market should take over setting interest rates. He argued that while the Fed should still oversee banking safety and payment systems, it shouldn’t control interest rates anymore.

In short, Trump is challenging how the U.S. economy is managed—and with blockchain now entering the scene in a big way, we could be witnessing a massive shift in how financial power is handled in America.