Markets Rally on Fed Hints and AI-Crypto Optimism

**Markets React to Fed’s Jackson Hole Speech with Optimism**

Last Friday, Federal Reserve Chair Jerome Powell delivered a highly anticipated speech at the Jackson Hole Symposium, which caused a noticeable shift in market sentiment. Powell acknowledged that inflation has come down from its peak but is still not at the Fed’s 2% goal. He emphasized that the Fed is ready to adjust interest rates if inflation continues to drop, hinting at a possible rate cut in the near future. However, he made it clear that the Fed will move carefully and keep watching the data to avoid a rebound in inflation.

This cautious but optimistic tone sparked a positive reaction across financial markets. The S&P 500 jumped 1.52% on Friday, closing the week up 0.3% at 6,466 points. The U.S. dollar weakened on the rate cut hopes, boosting gold prices by 0.98%, bringing it close to $3,371. U.S. 10-year Treasury yields also fell sharply to 4.25%, reflecting increased demand for bonds.

Bitcoin (BTC) was among the big gainers for the week, surging past $117,000 as investor appetite for risk assets returned.

**Intel Deal with U.S. Government Strengthens Semiconductor Push**

In a major move for U.S. tech infrastructure, the government will take a 9.9% passive equity stake in Intel worth $8.9 billion. This investment comes through a conversion of CHIPS Act grants and Secure Enclave program funds into non-voting stock. While the government won’t have control or board seats, it secured a five-year warrant to buy an additional 5% if Intel’s ownership share in its foundry business drops below 51%.

This strategic deal is seen as part of broader efforts to boost domestic semiconductor manufacturing and reduce reliance on overseas chipmakers.

**U.S. and EU Clarify Tariff Rules in New Trade Framework**

The U.S. and European Union provided more details about their revised trade agreement, setting clear 15% tariffs on key goods like pharmaceuticals, semiconductors, lumber, and cars. While this offers clarity on previously vague rules, businesses remain cautious due to uncertainties around enforcement and long-term stability of the deal.

**Apple and Google Eye AI Collaboration for Siri Upgrade**

Apple is reportedly in early discussions with Google to use its Gemini AI model to enhance Siri’s capabilities. This potential partnership between two tech giants triggered a surge in investor confidence, pushing Alphabet’s stock up by 4% and Apple’s by 2%. The move signals Apple’s growing focus on integrating advanced AI into its ecosystem.

**Tech Investment Trends: Who’s Spending Big on Innovation?**

According to UBS Weekly Intelligence, Meta, Intel, and Oracle are currently the biggest spenders when it comes to capital expenditures (capex) and research & development (R&D), based on their sales ratios. In contrast, companies like Mastercard, Uber, and Accenture are spending far less.

Among other top names: Microsoft spends 36% of its sales on capex and R&D, Amazon 31%, Alphabet 35%, and Apple 11%. These numbers highlight which companies are putting serious money into innovation, especially amid the ongoing AI boom.

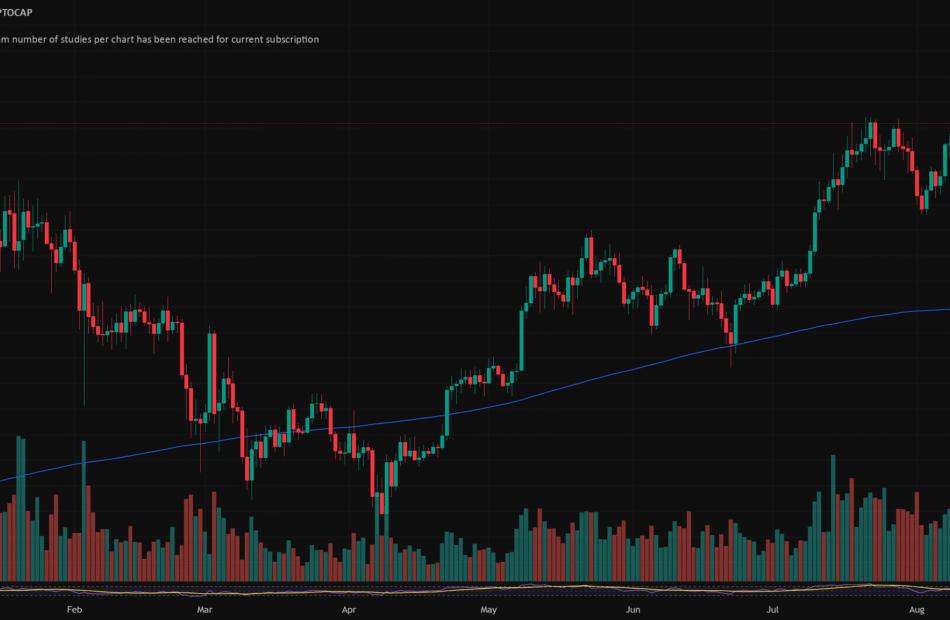

**Crypto Market Bounces Back After Fed Remarks**

Crypto markets got a boost following Powell’s Jackson Hole comments suggesting a potential rate cut soon. Bitcoin jumped back above $117K after dipping below $112K earlier in the week. Crypto-related stocks like MicroStrategy and Coinbase climbed 5–7%. Altcoins such as Ethereum (ETH) and Solana also surged — ETH rose by 15% on Friday alone, surpassing $4,800.

Despite Friday’s rally, the overall crypto market cap only grew modestly by $9 billion for the week. Trading volumes surged to $468 billion daily, up from $312 billion the week before. Since the start of the year, total crypto market capitalization has grown by 22%, with $702 billion in net inflows.

Ethereum stood out as a top performer last week, gaining 7% and adding over $37 billion to its market cap — reaching a new all-time high of $4,877. Meanwhile, Bitcoin ended the week down 2.13%, dropping to $115K during Saturday trading. Other altcoins showed mixed results: Chainlink (LINK) rose by 14.5%, ZCash gained 16%, and Solana increased by 7.5%. Maker was one of the few laggards, falling by 7.3%.

In terms of circulating supply changes, Polkadot saw a slight increase of 0.6%, while Filecoin’s supply dropped by 0.6% — a rare occurrence for this coin. Cardano (ADA) also increased its supply by 0.3%, and Bitcoin’s circulating coins were up slightly by 0.1%.

**Crypto Futures: ETH Bullish While BTC Lags**

In the crypto futures market, Bitcoin futures saw slight declines across all contracts. The steepest drops were in March 2026 (-2.08%) and June 2026 (-1.93%). Despite short-term softness, long-term sentiment remained stable with December 2026 BTC futures closing at $126,795.

Ethereum futures painted a more bullish picture with strong weekly gains around 10% across all maturities. The October 2025 contract rose the most at +10.3%. December 2026 ETH futures hit an all-time high of $5,347, while December 2025 closed at $4,994 — showing strong investor confidence in Ethereum’s long-term growth.

Overall, last week showcased a renewed appetite for risk among investors across both traditional markets and digital assets, driven largely by hopes of easing monetary policy and growing excitement around artificial intelligence and blockchain innovation.