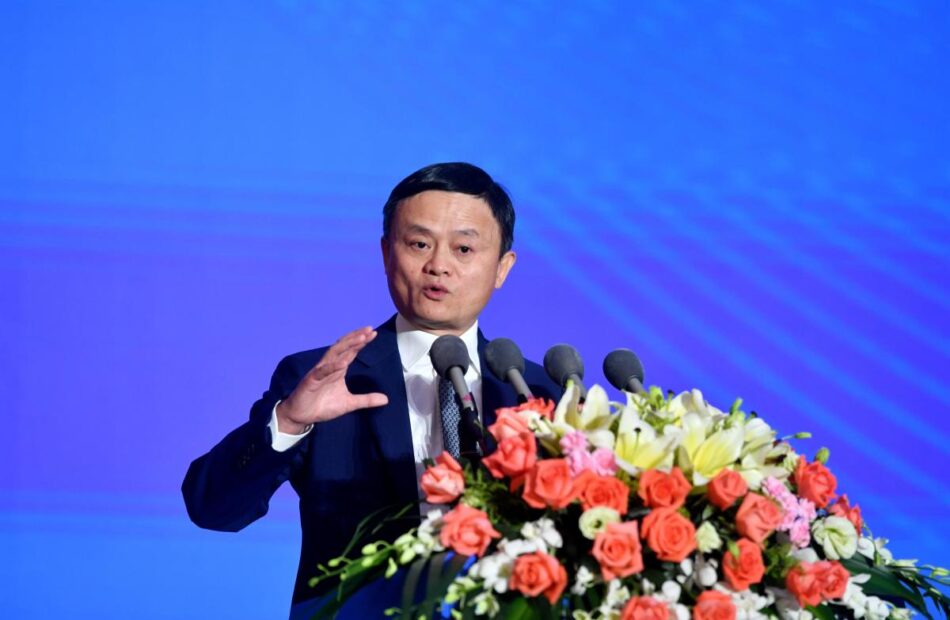

Jack Ma’s Yunfeng Buys $44M in Ethereum via Hong Kong

**Jack Ma’s Yunfeng Financial Buys $44M in Ethereum – Legal Loophole or Smart Move?**

Jack Ma, the well-known founder of Alibaba, is making waves in the crypto world—again. His financial company, Yunfeng Financial Group, has just made a big investment: buying 10,000 Ethereum (ETH), worth around $44 million. But with China’s strict ban on crypto, many are asking—how is this even allowed?

Let’s break it down.

### What Did Yunfeng Financial Do?

Yunfeng Financial, a Hong Kong-listed company co-founded by Jack Ma, officially announced it is buying 10,000 ETH from the open market. The company is using its own cash for the purchase and plans to hold Ethereum as part of its strategic reserve assets. This means Ethereum will now be part of Yunfeng’s balance sheet—just like cash, stocks, or real estate.

The company says this move supports its shift into new digital sectors like Web3, AI (Artificial Intelligence), and ESG (Environmental, Social, and Governance) Net Zero Assets. Ethereum will play a key role in these plans, especially for tokenizing real-world assets (RWA), which is basically turning physical things like real estate or art into digital tokens that can be traded online.

### Why This Is a Big Deal

China has banned crypto trading and mining since 2021. The government shut down exchanges and made it illegal for financial institutions to offer crypto services. The goal was to control capital outflow and protect financial stability.

So how can Jack Ma’s company buy millions in Ethereum without breaking the rules?

Here’s the catch: Yunfeng Financial is based in Hong Kong. Although Hong Kong is part of China, it follows a different set of laws under the “one country, two systems” model. In Hong Kong, crypto trading is legal and regulated. This allows Yunfeng to make moves in the crypto world that would be illegal on the mainland.

In short, Jack Ma isn’t technically breaking any laws because his company is operating under Hong Kong’s legal system.

### What Yunfeng Says About Ethereum

Yunfeng believes Ethereum isn’t just for speculation—it’s an essential building block for the future of finance. The company sees ETH as key to its move into decentralized finance (DeFi), tokenized assets, and blockchain-powered financial systems.

By adding Ethereum to its corporate treasury, Yunfeng joins a growing list of global companies that are treating cryptocurrencies like Bitcoin and ETH as reserve assets. These companies are using crypto to hedge against economic uncertainty while also preparing for a more digital future.

Yunfeng said it will continue to monitor the market and may adjust its ETH holdings based on regulatory updates or market conditions.

### What’s Next?

This move shows that institutional adoption of Ethereum is gaining speed. While retail traders have long been active in crypto, now large companies are starting to treat ETH as a core asset—not just a risky bet.

And despite China’s strict anti-crypto stance, Jack Ma has found a legal path through Hong Kong to tap into blockchain innovation. It’s a clever strategy that could influence how other Chinese-linked firms approach crypto in the future.

### Quick Facts

– **Jack Ma** is the co-founder of Alibaba and Yunfeng Financial.

– **Yunfeng Financial** has bought 10,000 ETH ($44M) using its own funds.

– **Ethereum** will be used for Web3 innovation and tokenizing real-world assets.

– **Crypto is banned** in mainland China, but **legal in Hong Kong**, where Yunfeng is based.

– This move highlights **growing institutional interest in Ethereum** as a long-term asset.

### FAQ

**Q: Who is Jack Ma?**

A: A Chinese entrepreneur best known for founding Alibaba. He also co-founded Yunfeng Financial Group.

**Q: Is Jack Ma involved in crypto?**

A: Yes. Through Yunfeng Financial, he’s now indirectly investing in Ethereum as part of the company’s digital asset strategy.

**Q: Isn’t crypto banned in China?**

A: Yes, on the mainland. But Hong Kong has its own crypto-friendly regulations, which companies like Yunfeng can legally operate under.

**Q: Why did Yunfeng buy Ethereum?**

A: To support its shift into digital sectors like Web3 and tokenized finance—and to hold ETH as a reserve asset on its balance sheet.

This bold move by Yunfeng Financial signals more than just another big crypto buy—it shows how companies are preparing for a digital-first financial future, even within complex legal frameworks.