Ethereum Struggles Despite Price Bounce and DeFi Strength

On February 10, Ethereum (ETH) surged past $2,100 as both Bitcoin and U.S. stock markets bounced back. This rally came after ETH had dropped steeply — falling 43% in just nine days to a low of $1,750. Since then, it has recovered about 22%, but the market is still cautious about Ethereum’s short-term direction.

In the crypto derivatives market, traders aren’t showing strong confidence. The two-month futures premium for ETH is hovering around 3% annually — below the neutral 5% level. This suggests that traders are still wary and that bearish sentiment remains in control. Even though ETH’s price has risen, investor outlook in the derivatives space hasn’t really improved over the past month.

Looking at on-chain data and overall market performance, Ethereum has lagged behind the broader crypto market by about 9% so far in 2024. This underperformance raises concerns about where investor money is going and whether Ethereum is losing momentum.

Still, Ethereum remains a dominant force in decentralized finance (DeFi). It leads the industry in Total Value Locked (TVL) — a key metric for blockchain usage — accounting for 58% of all funds locked in DeFi projects. If you include Layer 2 networks like Base, Arbitrum, and Optimism, Ethereum’s total share of TVL rises to over 65%. It also leads in fee revenue, showing that its network is still widely used and trusted.

However, not everything is smooth sailing. On-chain activity has slowed down recently, ending Ethereum’s deflationary trend — where more ETH was being burned than created. Now, ETH supply is growing again at an annualized rate of 0.8%, much higher than the near-zero growth rate seen a year ago.

There are also rising concerns about the long-term sustainability and security of Layer 2 solutions built on Ethereum. Vitalik Buterin, Ethereum’s co-founder, recently said the community needs to refocus on scaling the mainnet itself. He pointed out that some L2 solutions may not be decentralized or secure enough.

Overall, investor sentiment remains cautious. Uncertainty in the U.S. job market and questions about whether investments in AI infrastructure can keep growing have made people more risk-averse. The weak activity in Ethereum’s derivatives market shows that traders don’t yet believe in a strong short-term recovery. For now, more time and data are needed before anyone can confirm that Ethereum has hit a true bottom.

Fortune Three Lions by Gameplay Interactive (GPI)

Fortune Three Lions by Gameplay Interactive (GPI)

Welcome the exciting year ahead with fresh beginnings, abundance and prosperity. May the year ahead bring good fortune, strong health, and joyful moments. May the blessing from Fortune Three Lions bring you great wealth and luck!

Overview

Welcome a prosperous and abundant year with Fortune Three Lions! With its respin feature that can triple your luck! 243 ways to win on classic 3×5 reels and collect coins during the respins features!

Game Highlights

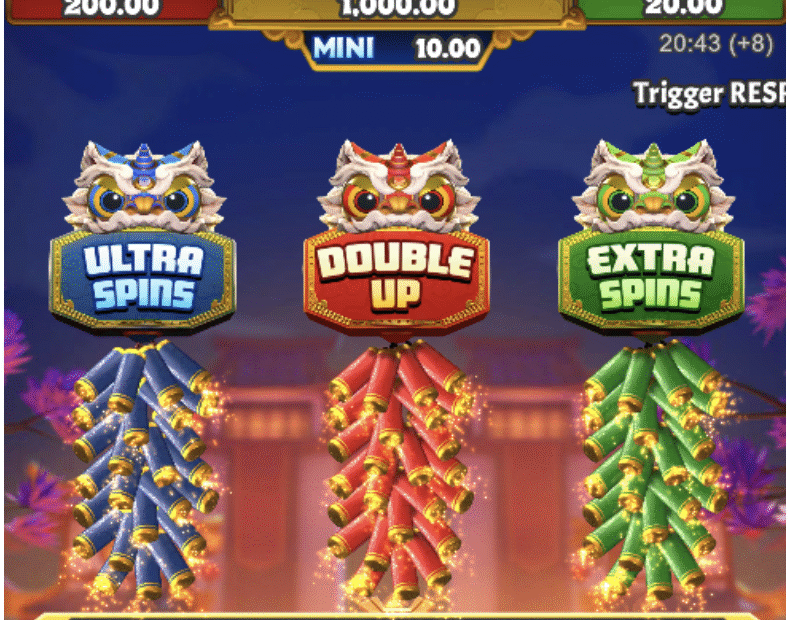

- 243 ways : 3 x 5 Reel with up to 243 ways to win

- Red Lion Respins : Double up – Respins feature with 2 Reels on top of each other. Collect double the Coins with more reel positions to fill!

- Blue Lion Respins : Ultra Spins – Adds additional wins to the coins collected during the respin feature!

- Green Lion Respins : Extra Spins – Add additional spins to the respin feature while collecting coin wins!

- Triple Respin Feature: Randomly trigger all 3 respin features at the same time! Bigger winnings, double the reels and more spins!

Game Info

- Reels: 3 x 5 Reels

- No. of ways: 243 ways

- Default RTP: 96.45%

- Min and Max Bet: Reflected based on the player’s currency.

- Example: A bet of USD 1.00 with 88 credits in 243 ways yields a total bet per spin of USD 8.80.

About Gameplay Interactive (GPI)

As a rising star in the iGaming industry, Gameplay Interactive is dedicated to delivering innovative and engaging entertainment solutions. With a portfolio of innovative titles, the company continues to set new standards in gameplay, design, and player engagement.

For more information about Gameplay or to explore partnership opportunities, visit gameplayint.com.

KIMI AI Predicts XRP $8, BTC $250K, ETH $20K by 2026

**Disclaimer:** Crypto is a high-risk investment. This content is for informational purposes only and not financial advice. You could lose your entire investment.

—

### Alibaba’s KIMI AI Predicts Big Crypto Price Surges in 2026

Alibaba’s artificial intelligence, KIMI, is making bold predictions for major cryptocurrencies like XRP, Bitcoin, and Ethereum. According to the AI model, if the crypto market enters a long bull run and U.S. regulations become more supportive, we could see record-breaking prices in the near future.

Here’s a breakdown of KIMI’s forecast for XRP, Bitcoin, Ethereum, and a rising meme coin called Maxi Doge.

—

### XRP Could Hit $8 by End of 2026

XRP, the token linked to Ripple, started 2026 strong with a 19% gain in the first week and is currently trading around $1.89. Alibaba’s KIMI AI predicts XRP could rise to $8 by the end of 2026 — that’s over 300% higher than its current price.

XRP gained massive attention after Ripple won a key legal battle against the U.S. Securities and Exchange Commission (SEC). That victory reduced legal uncertainty and lifted investor confidence. The return of Donald Trump to the White House has also sparked optimism for more crypto-friendly policies.

Right now, technical indicators show more selling than buying, but XRP is forming a bullish flag pattern. If this pattern breaks upward — especially with better regulations and macro trends — the path to $8 could become more realistic.

Also boosting XRP’s future are newly approved spot XRP ETFs in the U.S., which are starting to attract traditional investors, similar to what happened with Bitcoin and Ethereum ETFs.

**Keywords**: XRP price prediction, Ripple news, crypto ETF, XRP bull market, crypto regulation

—

### Bitcoin May Reach $250,000

Bitcoin (BTC), the biggest cryptocurrency by market cap, hit an all-time high of $126,080 in October. KIMI AI sees even more growth ahead, forecasting a potential rise to $250,000.

Often called “digital gold,” Bitcoin remains a favorite for investors looking to hedge against inflation and global economic uncertainty. It currently trades around $87,800 and holds about $1.8 trillion of the total $3.06 trillion crypto market.

While recent geopolitical tensions have caused slight price dips — like the EU reacting to Trump’s comments about Greenland — long-term factors look positive. If inflation cools down and clearer crypto regulations are introduced in the U.S., Bitcoin could break new records.

There’s also buzz around the U.S. possibly creating a Strategic Bitcoin Reserve. If that happens, it could push Bitcoin well beyond current forecasts.

**Keywords**: Bitcoin price forecast, BTC ATH, digital gold, Bitcoin regulation, strategic reserve

—

### Ethereum Could Soar to $20,000

Ethereum (ETH), the go-to platform for smart contracts and DeFi apps, is still leading the Web3 space. It has over $351 billion in market cap and $69 billion locked in DeFi protocols.

Trading near $2,900 now, ETH faces strong resistance at around $5,000 — just below its previous all-time high of $4,946.05. But if it breaks above that level with strong momentum, Alibaba’s KIMI AI suggests Ethereum could surge between $7,500 and even up to $25,000.

Ethereum is favored for its security and reliability in handling stablecoins and real-world asset tokenization. If U.S. lawmakers pass clearer crypto laws this year, it could lead to much larger adoption by institutions.

**Keywords**: Ethereum price prediction, ETH forecast, DeFi leader, smart contract platform, crypto regulation

—

### Maxi Doge: A Meme Coin with Big Hype

Maxi Doge (MAXI) is a new meme coin that’s gaining serious attention. It raised over $4.5 million in its presale this January alone.

Inspired by Dogecoin but with an exaggerated “gym bro” personality, Maxi Doge is attracting fans of high-risk trading and meme culture. It’s built on Ethereum’s energy-efficient proof-of-stake network and has a much smaller environmental impact than Dogecoin.

MAXI is available as an ERC-20 token during its presale and offers up to 69% APY if staked early. As more people join in, staking rewards will go down. The current presale price is $0.0002801 and increases automatically after each funding milestone. You can buy it using MetaMask or Best Wallet.

Maxi Doge is building its own loyal following — known as the “Maxi Doge Army” — ready to take over the meme coin scene.

**Keywords**: Maxi Doge presale, meme coin 2026, high APY staking crypto, ERC-20 meme token, Dogecoin alternative

—

Stay tuned for updates on these trending cryptocurrencies as we move deeper into 2026 — it could be one of the most exciting years yet for crypto investors.

Alibaba AI Predicts Crypto Surge: BTC $250K, ETH $20K

**Alibaba AI Predicts Major Crypto Price Surges by 2026: Bitcoin to $250K, Ethereum to $20K, XRP to $8**

China’s Alibaba has an advanced artificial intelligence model called KIMI, which is turning heads with bold predictions for the future of cryptocurrency. According to KIMI, the next two years could bring massive gains for top digital assets like Bitcoin (BTC), Ethereum (ETH), and XRP—thanks to a long-lasting bull market and clearer crypto regulations in the U.S.

Here’s a simplified breakdown of what Alibaba’s AI expects by the end of 2026:

—

**XRP Could Reach $8 by 2026**

Ripple’s XRP is already showing strength, starting 2026 with a 19% jump and currently trading around $1.89. According to Alibaba AI, if the positive momentum continues and regulatory clarity improves, XRP could climb to $8. That’s more than four times its current value—a potential 323% gain.

Last year, XRP hit a seven-year high of $3.65 after Ripple won a key legal battle against the U.S. Securities and Exchange Commission (SEC). The victory cleared up a lot of the legal uncertainty surrounding XRP, encouraging more investor confidence.

There’s also growing excitement as spot XRP ETFs have been approved in the U.S., opening the doors for institutional investment—similar to what we’ve seen with Bitcoin and Ethereum ETFs.

Despite some current selling pressure shown on technical charts, XRP is forming a bullish flag pattern. This setup, combined with favorable market conditions and more crypto-friendly policies, could spark a big breakout toward the $8 target.

—

**Bitcoin on Track to Hit $250,000**

Bitcoin (BTC), the most valuable cryptocurrency by market cap, recently set a new all-time high at $126,080. Alibaba AI believes that Bitcoin could potentially double from here and reach $250,000 before the end of 2026.

Often called “digital gold,” Bitcoin continues to be a top choice for both individual and institutional investors looking to hedge against inflation and economic instability.

Currently trading near $87,800, Bitcoin holds about $1.8 trillion of the entire crypto market’s $3.06 trillion value. Short-term dips are expected due to geopolitical events like recent EU-U.S. tensions, but overall momentum remains strong.

If the U.S. moves forward with proposals like creating a Strategic Bitcoin Reserve and continues to improve crypto regulation, Bitcoin could smash past its current highs.

—

**Ethereum Forecasted to Soar to $20,000**

Ethereum (ETH) is the backbone of decentralized applications, smart contracts, and DeFi projects. It has a solid position in the crypto space with a market cap over $351 billion and around $69 billion locked into DeFi platforms.

ETH is currently trading around $2,900. The next big resistance level is at $5,000—the previous all-time high was just under that at $4,946 in August.

If Ethereum breaks past this level, Alibaba’s AI sees it reaching as high as $20,000 in a bullish scenario. With its strong security features and leadership in tokenized assets and stablecoins, Ethereum is well-positioned for increased institutional adoption—especially if U.S. lawmakers deliver on promised crypto legislation.

—

**Maxi Doge Raises Over $4.5M in Meme Coin Presale**

Outside of these major cryptocurrencies, there’s growing buzz around a new meme coin called Maxi Doge (MAXI). This over-the-top parody of Dogecoin has already raised more than $4.5 million during its presale stage.

Maxi Doge plays into meme culture with high energy and humor, attracting traders who enjoy risk-taking and sharp price swings. The token runs on Ethereum’s proof-of-stake network, making it more environmentally friendly than Dogecoin’s proof-of-work system.

Presale participants can earn up to 69% APY by staking their MAXI tokens early. As more people join in, rewards will decrease. Right now, MAXI is priced at $0.0002801 and increases slightly at each funding milestone. Investors can buy MAXI through MetaMask or Best Wallet.

Maxi Doge isn’t just another meme coin—it’s aiming to be the next big name in meme culture-driven crypto.

—

**Summary**

– **XRP** could hit **$8** by 2026 if bullish trends and regulatory clarity continue.

– **Bitcoin** may reach **$250,000**, driven by long-term adoption and strong investor interest.

– **Ethereum** has the potential to soar to **$20,000**, thanks to its central role in DeFi and Web3.

– **Maxi Doge**, a new meme coin, has raised over **$4.5 million** and is gaining popularity fast.

The crypto market could be headed for big changes as AI predictions, legal progress, and new technologies shape its future. Whether you’re into blue-chip cryptos or meme coins, it might be time to pay close attention.

ZKP Gains Traction Amid Crypto Market Fear

**Crypto Market Update: Fear Grows, But New Blockchain Project ZKP Gains Attention**

The crypto market is currently in a cautious mood. The Fear & Greed Index has dropped to 20, showing that investors are becoming more fearful and risk-averse. Bitcoin is hovering around $87,400, while Ethereum is sitting near $2,860 after dropping by about 7% recently.

**Why Are Crypto Investors Nervous Right Now?**

There are several reasons behind the current uncertainty in the crypto space. Investors are waiting for the next U.S. Federal Reserve meeting, which could bring changes to interest rates. There’s also renewed concern about a potential government shutdown in the U.S. These macroeconomic issues are shaking confidence in high-risk markets like crypto.

As a result, retail traders—everyday investors—are pulling back. Data from Bitget shows around $4 billion in daily trading volume has shifted from crypto to traditional safe-haven assets like gold and stock market indices. On the other hand, larger investors (also known as whales) are using this dip to accumulate top cryptocurrencies like Bitcoin and Ethereum.

**Spotlight on ZKP: A Privacy-Focused Blockchain Project**

In the middle of this market slowdown, early-stage blockchain projects are catching some attention—especially ones not yet listed on exchanges. One such project is **ZKP**, a new Layer 1 blockchain focused on privacy and verifiable computation.

ZKP uses **zero-knowledge proof (ZKP)** technology to allow computations to be verified without revealing the underlying data. This is especially useful in data-heavy environments like artificial intelligence, where data privacy is essential.

**How ZKP Is Different From Other Crypto Projects**

ZKP stands out because it built its infrastructure first—before launching a token. The team has already invested over $100 million of their own money to create a working multi-layer blockchain and hardware called **Proof Pods**. These hardware units support verified computation on the network and ensure that participation is tied to real activity—not just speculation.

Instead of doing private sales or giving early access to insiders, ZKP is running a **450-day public presale auction**, divided into 17 stages. Each day offers a set number of tokens (190 million in Stage 2), and participants get equal pricing based on their contribution during that 24-hour window. Any unsold tokens are permanently removed from circulation, reducing supply over time.

**Why Early Access to Projects Like ZKP Is Rare Now**

Most well-known blockchain networks launched years ago and are already fully developed. It’s becoming harder for new investors to get in early on promising projects. ZKP gives people a chance to join before it hits public markets, with the added benefit of an operational network already in place.

Because it’s a working product—not just an idea—ZKP offers a unique opportunity for those looking to get involved in early-stage blockchain tech that focuses on privacy and transparency.

**A Clear Structure Instead of Hype**

ZKP doesn’t rely on flashy marketing or big promises. Instead, its presale process is simple and structured. Token pricing changes slowly over time, with rules laid out clearly from the start. Big wallets don’t get special treatment—the system limits large-scale influence to keep things fair.

The inclusion of **Proof Pods** also shows that ZKP is focused on real utility rather than just short-term hype. These physical devices help support computations on the network, linking participation to actual use rather than speculation.

**Conclusion: ZKP Offers Stability in an Uncertain Market**

With fear rising across the crypto market, many investors are looking for solid projects with real infrastructure and clear rules. ZKP fits that need by offering a working blockchain, a fair token sale model, and a focus on privacy through zero-knowledge cryptography.

As always, investing in early-stage crypto projects carries risk. Make sure to do your own research and understand your risk tolerance before getting involved.

**Learn More About ZKP:**

– Website: https://zkp.com/

– Buy Tokens: http://buy.zkp.com/

– X (formerly Twitter): https://x.com/ZKPofficial

– Telegram Community: https://t.me/ZKPofficial